The 2023/24 club football season introduced a wealth of impressive performances. While our previous article examined these from a business perspective, this analysis delves into the social media performance of leagues, clubs, and players during the same period, uncovering some captivating trends.

Follower growth slows in Europe, but speeds up in Saudi Arabia and the USA

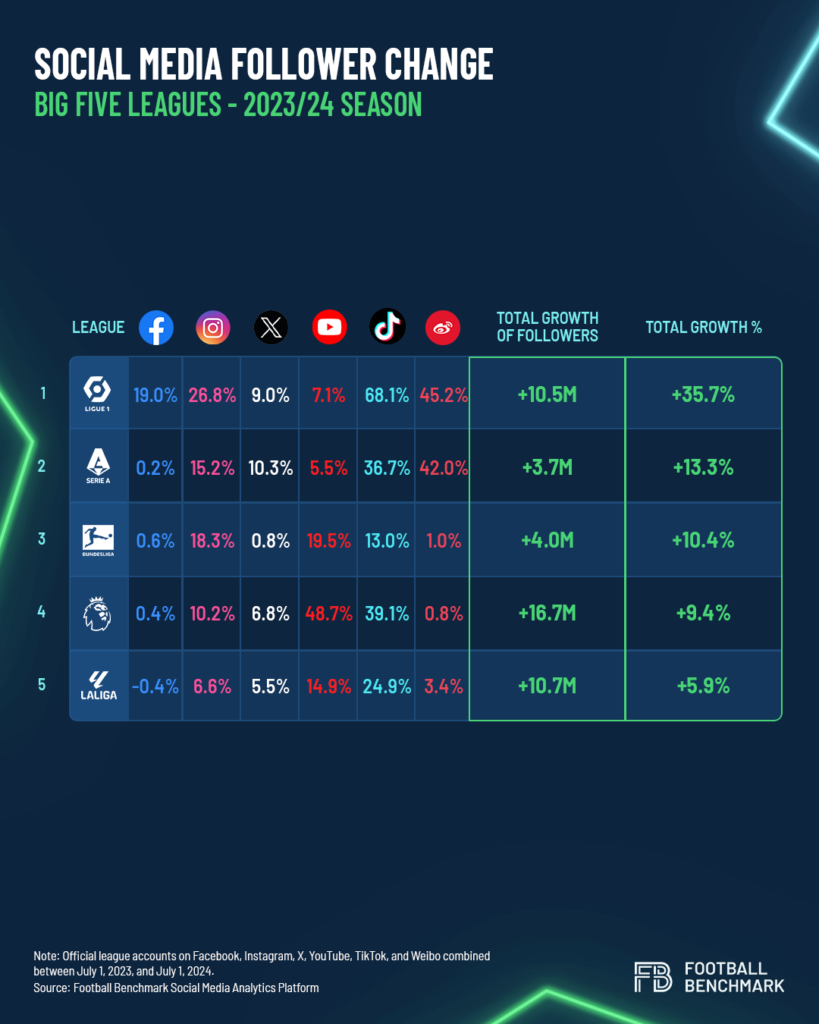

International football leagues have strategically focused on three key platforms to drive their social media growth throughout the season. Alongside Instagram, which remains essential in the football world, significant follower growth was observed on TikTok and YouTube for the European “Big Five” leagues. Unsurprisingly, these video-centric platforms have risen to prominence in football as well, aligning with evolving consumer habits.

The top five European football leagues experienced a slowdown in social media follower growth rates compared to the previous season. In the 2022/23 season, LaLiga saw a substantial growth of 28.8%, which dropped significantly to 5.9% in 2023/24. Similarly, the English Premier League’s growth decreased from 20.2% in 2022/23 to 9.4% in 2023/24.

Among these leagues, Ligue 1 emerged as the best performer, achieving a robust 35.7% growth in 2023/24, following an impressive 47.8% in the previous season. Much of Ligue 1’s new follower base came from TikTok, highlighting the platform’s growing influence in sports marketing and fan engagement.

When analyzing social media strategies, it is notable that two leagues significantly strengthened their presence on the Chinese Weibo platform – Serie A and Ligue 1 – while the German Bundesliga, the English Premier League, and LaLiga focused on YouTube and TikTok prominently.

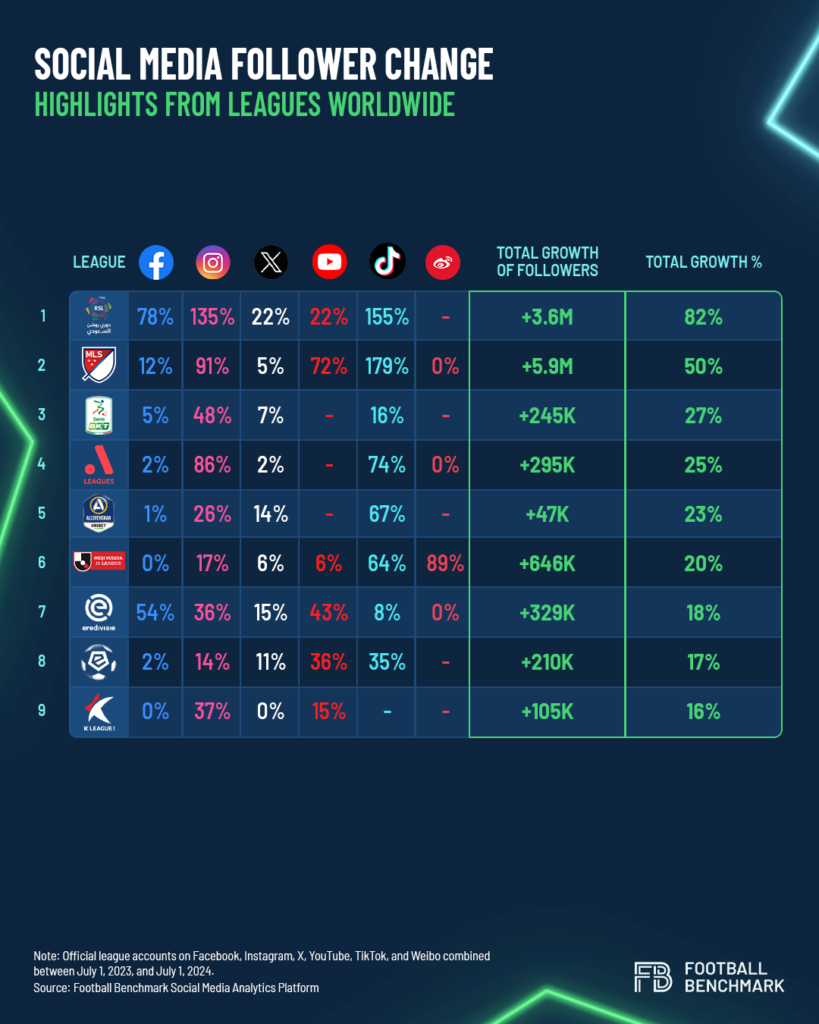

Outside the “Big Five” European leagues, the most spectacular follower growth occurred in Saudi Arabia and in the USA, driven by global superstars Cristiano Ronaldo and Lionel Messi, along with other high-profile players who also joined these leagues.

The surge in interest in the Saudi Professional League is evident from its follower growth, which nearly matched that of the German Bundesliga and Serie A: the Saudi top league gained 3.6 million new followers during the period under review, compared to Serie A’s 3.7 million and the Bundesliga’s 4 million. Major League Soccer (MLS) gained 5.9 million new followers during the analyzed period, surpassing the follower growth of two of Europe’s “Big Five” leagues.

Strategic focus on video content: leveraging TikTok and YouTube

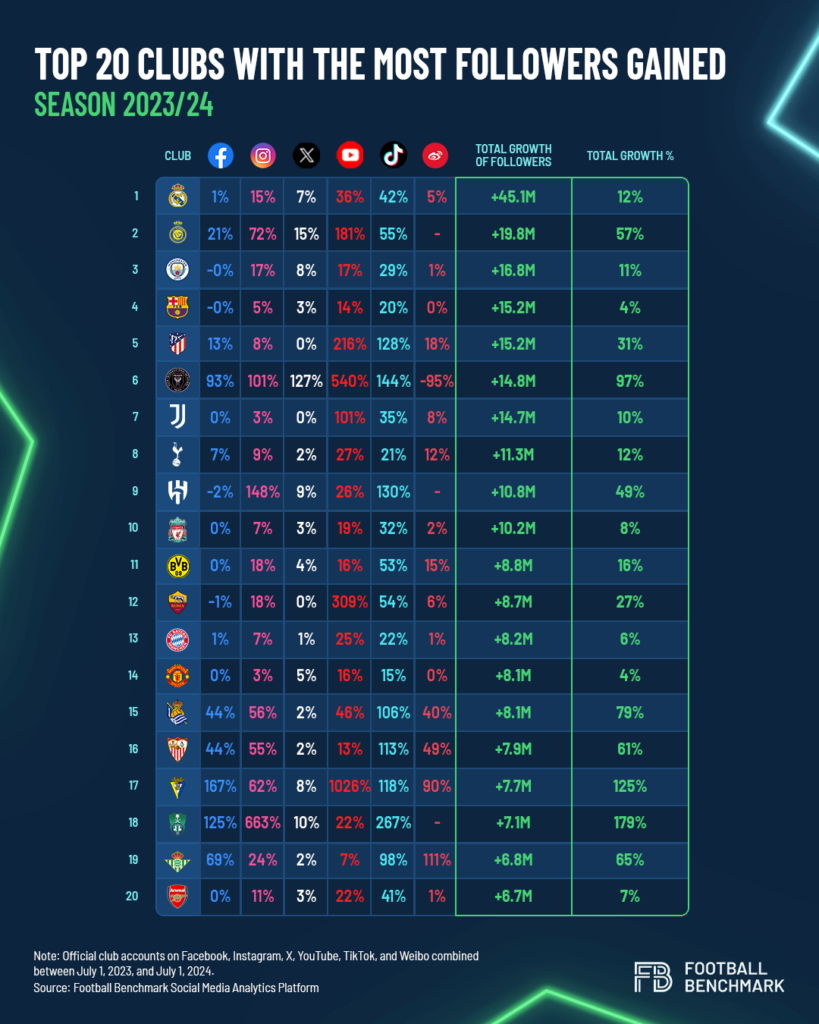

The same trend observed in leagues is also noticeable among clubs: YouTube and TikTok have been the primary channels where clubs have gained the highest number of new followers, focusing their growth strategies accordingly.

Among the top 20 clubs that gained the most followers during the season, seven are from LaLiga, five from the English Premier League, and three from the Saudi Professional League. Interestingly, despite LaLiga teams significantly increasing their follower base, the league’s overall follower growth lagged behind previous years.

In terms of percentage growth in follower numbers among the top 20 examined clubs, Spanish and Saudi clubs stand out prominently. Al-Ahli Saudi FC achieved an impressive +179%, and Cádiz CF followed with +125%. Other notable clubs include Inter Miami CF, Real Sociedad de Fútbol, Real Betis Balompié, Sevilla FC, Al-Nassr FC, and Al-Hilal SFC. On the other end of the spectrum, top clubs like FC Barcelona (+4%), Manchester United FC (+4%), and FC Bayern München (+6%) saw only minimal increases in their follower base during the season, although as they are among the global leaders in this field, high percentage increases will always be difficult for them.

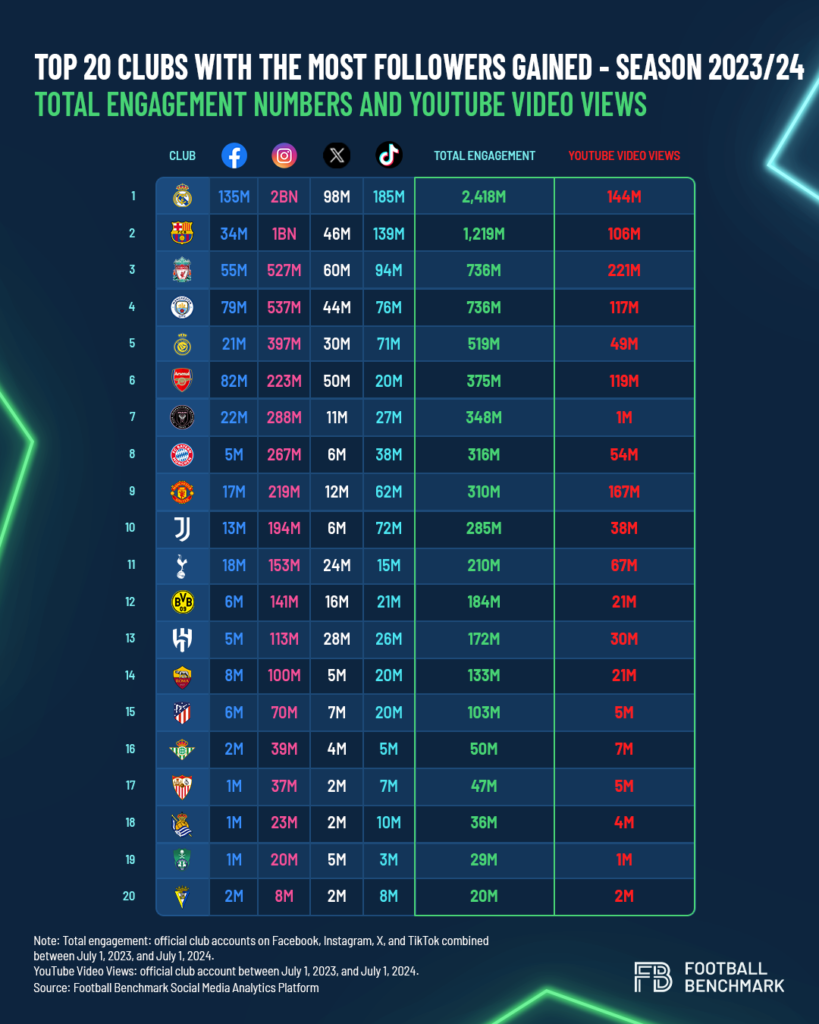

Real Madrid CF, which gained the most new followers (+45.1M), also lead the total engagement list by a wide margin. Throughout the season, their content on Facebook, Instagram, TikTok, and X generated 2,418 million engagements.

The global fan communities of the two Spanish giants, Real Madrid and Barcelona, are incredibly active. However, Liverpool FC and Manchester City FC’s fan bases also demonstrated notable engagement throughout the season. Outside the top 20 clubs examined, Chelsea FC (410M), Galatasaray SK (305M), FC Internazionale Milano (195M), AC Milan (192M), SL Benfica (82M), and Bayer 04 Leverkusen (77M) also showed outstanding activity.

Regarding YouTube video views, Liverpool lead the pack with 221 million views on their channel during the period under review. In addition to match highlights, the resignation of the club’s legendary coach, Jürgen Klopp, drove significant traffic to their channel. Following Liverpool on this list are Manchester United, Real Madrid, Arsenal, Manchester City, and FC Barcelona, all of which surpassed 100 million views during the season.

Real Madrid’s social media dominance – impact on player’s follower numbers

Real Madrid boast the largest social media following globally among football clubs, and indeed across all sports clubs. Therefore, it’s unsurprising that this also has a significant impact on the number of followers for the club’s players.

When examining the follower growth of players in Europe’s top five leagues and beyond, one trend immediately stands out: the exceptional performance of Real Madrid players and future recruits in this area.

Of the 15 players on the list, 10 were with Real Madrid during the 2023/24 season. Adding Kylian Mbappé, who will join the Spanish giant next season, and Sergio Ramos, a legend of “Los Blancos”, brings the total to 12 players linked to the club. The most spectacular percentage growth in followers was seen with French international Aurélien Tchouaméni, European Golden Boy winner Jude Bellingham, and former Manchester City player Brahim Díaz.

The activity and strength of Real Madrid’s community are further highlighted by the significant growth in the follower base of Endrick, who has seen a surge in followers since the announcement of his transfer to the club.

In our analysis of player follower growth outside the “Big Five” leagues, it’s striking that five players hail from the Saudi Professional League. This trend underscores the increasing attention and support these players are receiving from fans of Saudi clubs.

In conclusion, the 2023/24 club football season not only showcased impressive on-field performances but also highlighted notable shifts in social media engagement across leagues, clubs, and players. MLS’s surpassing of several members of Europe’s “Big Five” in follower growth, along with Saudi clubs outperforming top European counterparts, underscores the evolving dynamics within football’s digital landscape.

This article was produced by Football Benchmark.

SHL: Social media insights from the 2023/24 club football season

The 2023/24 club football season introduced a wealth of impressive performances. While our previous article examined these from a business perspective, this analysis delves into the social media performance of leagues, clubs, and players during the same period, uncovering some captivating trends. Follower growth slows in Europe, but speeds up in Saudi Arabia and the USA International football leagues have strategically focused on three key platforms to drive their social media growth throughout the season. Alongside Instagram, which remains essential in the

Season Ticket Campaing: when the passion meets commercial

During this time of the year without live football, following the sport we love might seem dull. However, especially for those viewing football through the eyes of insiders, this period becomes very interesting. Between the transfer market, confirmed and newly announced marketing partnerships, social media presentations of new signings, and creative season ticket campaigns, June and July become special months without club football. Today, we focus on season ticket campaigns. This summer, more than others, clubs seem to have returned to

SFS unveils new logo and website: the future of football is here

SFS is excited to announce an important evolution in our journey: the launch of the new logo and website. These updates have been made to enhance the communication of our numerous activities and to best reflect the growth and expansion of our event. The new SFS logo embodies a dynamic and modern identity, representing our mission to be pioneers in the football industry. With clean lines and a contemporary design, the logo symbolizes the innovation and passion that drive every initiative. It is an

Overachievers and Underachievers: Snapshot of the 2023/24 season in the Big Five leagues

The 2023/24 European football season was a year of diverse achievements and unexpected outcomes in the Big Five leagues. From dominant performances to historic upsets, clubs navigated varied paths towards success or challenges. This article examines the 2023/24 season’s highlights across financial and competitive metrics. It contrasts expectations with actual outcomes to identify the overachievers and underachievers of the season, through a comparison between financial figures and on-field performance. Top 20 clubs by total operating revenue and their 2023/24 final league positions The

Euro 2024 vs. Copa America 2024: A Comparative Analysis of Football Teams’ YouTube Engagement

Comparing the data of Euro 2024 teams with Copa America 2024 teams provides an insightful view into how top national football teams perform online, particularly on YouTube, based on data from BuzzMyVideos. Euro 2024 Teams England - Subscribers: 2.66M - Total Views: 943.71M - Comment: England leads the digital space with the highest number of subscribers and total views, reflecting a strong online presence that mirrors their on-field performances. France and Germany - Strong Engagement: both teams show significant engagement, indicative of their solid football performance and popularity among

Strategic investment for companies: why partnering with the 7th edition of SFS matters.

This year marks the 7th edition of SFS. Over 7 years, it has been a platform for meetings, networking, knowledge sharing, and insights into the future of the football industry. Organized by Go Project and Social Media Soccer, the event will take place on Tuesday, November 19th and Wednesday, November 20th, 2024, at the Stadio Olimpico in Rome. Within the context of the football industry, supporting SFS represents a unique opportunity within a corporate communication strategy. It allows brands to associate

From Suning to Oaktree: analysing FC Internazionale’s financial evolution

Right after the celebrations of their 20th title and the much-coveted second star, FC Internazionale Milano saw a change in ownership with the American fund Oaktree Capital Management taking control of the club after the Chinese conglomerate Suning Group failed to repay a EUR 395m three-year loan to the US fund. This article explores the economic and financial evolution of the club under Suning's ownership, which began in June 2016 when the Zhang family acquired a majority stake (68.6%) in

Deloitte’s annual review of football finance 2024

BOLSTERED BY THE 2022 FIFA WORLD CUP, REVENUE IN THE EUROPEAN FOOTBALL MARKET GREW BY 16% IN THE 2022/23 SEASON TO €35.3 BILLION. The 2022/23 season proved to be a story of momentum shifts, in the first season since 2018/19 unmarred by COVID-19 effects, with a pause halfway through the club season for international play. While the overall market grew to €35.3billion, the ‘big five’ leagues continued to proportionately lead the way, contributing €19.6 billion (56%). The start of the Premier League’s new

FIFAe introduces National Team competition featuring Rocket League

In a groundbreaking partnership with Rocket League, FIFAe announced to expand its national team competition to one of the most popular esports titles. This move signifies a major step in FIFA’s commitment to drive the global growth of football esports globally. The partnership brings the intensity and excitement of the FIFAe nations’ narrative to an electrifying new stage and allows players to fame their game in their nation colours. This inclusion represents a broader engagement with the community and embraces esports

Youtube Stats of EURO2024 teams

According to the data from the martech company BuzzMyVideos; England and France are head-to-head in the Most Subscribed YouTube channels, with England ranking Number 1 with 2.68 million subscribers and France following closely with 2.63 million subscribers. Interestingly, the 3rd position is claimed by neither Italy, Spain, nor Portugal. Poland holds the 3rd most subscribed YouTube channel with 954,000 subscribers, followed by Spain with 517,000 subscribers and Italy with 478,000 subscribers. In terms of Total Views, England again claims the 1st spot with 950 million views, France is 2nd with 880 million views, and