Private Equity’s expanding footprint in football: Risks, rewards and the future

Brief Overview

Private equity’s role in football has grown significantly, with investments spanning clubs, leagues and sports institutions worldwide. Driven by football’s global appeal and potential for sustained revenue, private equity firms are reshaping the industry, from financial recovery efforts post-COVID to strategic modernization initiatives. While they offer stability and growth, these investments also raise questions about the balance between commercial gains and the sport’s cultural roots.

Key insights:

- Football’s global appeal fuels investment: Football’s unmatched global reach and loyal fan base make it highly attractive to private equity, as demonstrated by viewership numbers for events like the Champions League final compared to other major sports events.

- COVID-19 as a catalyst: The pandemic created significant financial strain on clubs, encouraging many to seek external funding and opening doors for private equity to step in and stabilize struggling teams and leagues.

- Diverse ownership models: Private equity involvement ranges from majority ownership, which allows for direct influence, to minority stakes, which support commercialization without heavy involvement in day-to-day operations.

- Clubs, leagues and broader sports investments: Private equity’s reach goes beyond individual clubs to include entire leagues and other sports like IPL cricket and Formula 1, reflecting a broad strategy that leverages sports’ commercial potential globally.

Introduction: Private Equity’s growing interest in football

This article explores private equity’s evolving role in football, delving into the reasons behind its increasing involvement while providing an overview of its broader impact on the sports industry. Private equity’s initial entry came in 2006 when three investment firms purchased a stake in PSG for a reported GBP 34 million, marking a modest yet significant first step into the world’s most popular sport. Fast-forward to 2022, Clearlake Capital acquired Chelsea for GBP 2.5 billion. Today, private equity investments range from league-wide financial partnerships to ownership stakes in individual clubs, with major players such as CVC Capital Partners, Elliott Management and Arctos Sports Capital leading the charge. Now firmly embedded in the industry, this presence begs the question: what exactly makes football such an attractive proposition for private equity?

The global stage: Football’s massive appeal

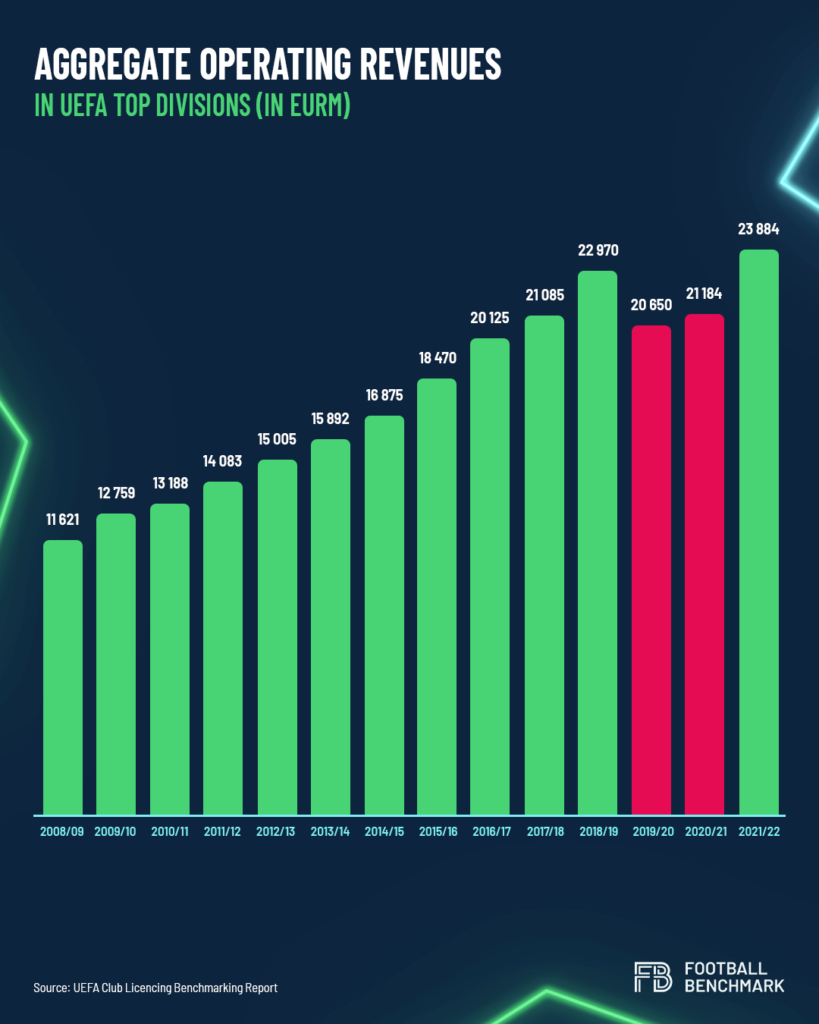

Football’s unparalleled global reach makes it particularly attractive for investors. As private equity firms are already active in various sports, from basketball to motorsports, their natural progression has led them to football. This shift makes sense, given football’s unmatched global appeal. UEFA reports that a staggering 450 million people tuned in for the 2023 Champions League final, dwarfing the 123 million viewers of the same year’s Superbowl. For private equity, these numbers highlight the potential for stable revenue, especially in European football, which demonstrated a swift recovery following the pandemic. In 2023 alone, revenue rose by 13% year-on-year, surpassing pre-pandemic levels and underscoring the sport’s resilience and sustained growth.

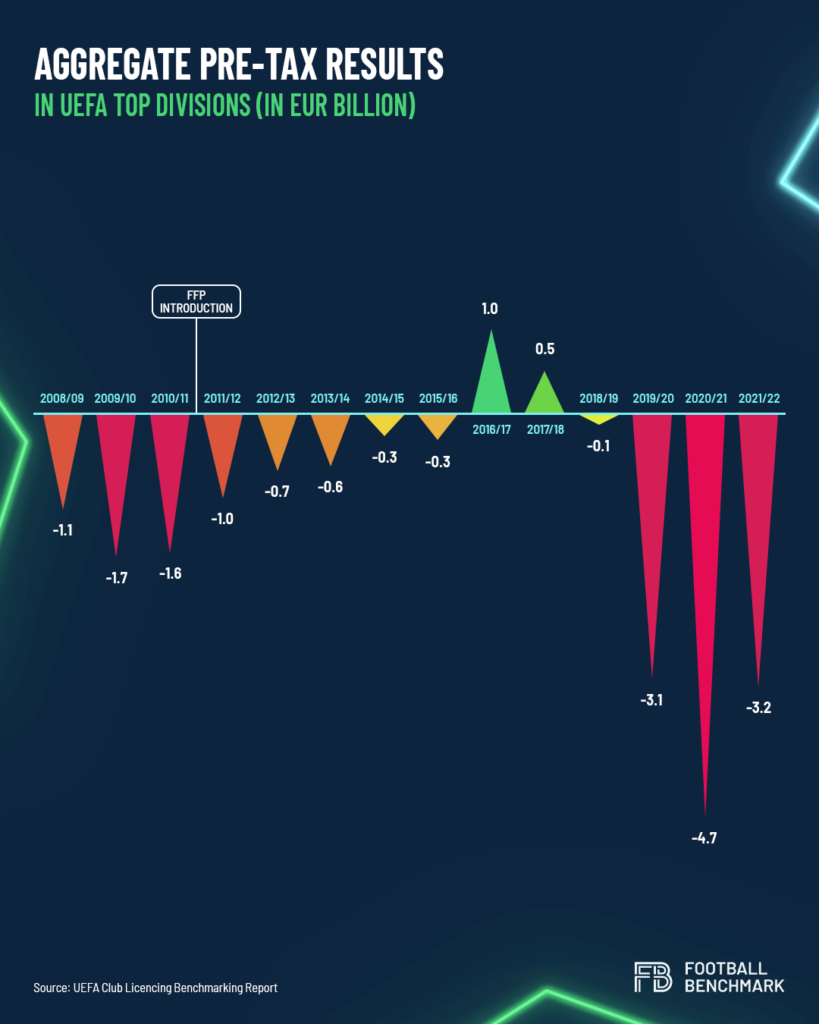

This recovery stems in part from tighter financial regulations, which have helped to limit the unsustainable debt that once characterized the industry. UEFA’s Financial Fair Play rules were instrumental in stabilizing the European football landscape. When FFP was introduced, over half of the 655 European top division clubs recorded annual losses. By the 2017/18 season, however, the industry had moved from a combined net loss of EUR 1.7 billion in 2009/10 to a net profit of EUR 500 million. These changes have made football more financially sound, transforming it into an investment opportunity that is hard for private equity to ignore. As a result, clubs and leagues are increasingly seen as sound financial assets capable of providing steady returns on investment.

COVID-19 pandemic: A reality check

While financial regulations had strengthened the sector, the COVID-19 pandemic introduced unprecedented challenges. Club revenues plummeted while costs remained high, pushing European football’s cumulative losses to nearly EUR 5 billion among top division clubs in the 2020/21 season. To offset this economic strain, clubs sought external capital, creating an environment ripe for private equity investment.

Many private equity firms, with abundant capital reserves, were quick to seize the opportunity. Financial regulations became stricter across Europe in response, with leagues adopting rules like the Premier League’s Profit and Sustainability Rules and La Liga’s cost-control measures, both designed to protect clubs’ long-term viability.

Clubs also began pursuing strategies to strengthen their financial resilience, such as diversifying revenue streams, investing in multipurpose stadiums and commercializing their brands globally. These efforts underscore football’s shift toward sustainability and self-reliance, which make it even more appealing to private equity investors looking for stable, long-term opportunities.

Private Equity & clubs: Varied ownership models in action

The European football ecosystem features a variety of ownership models, from sovereign wealth funds and private investors to private equity firms and member-owned clubs, each bringing unique perspectives and objectives. Private equity’s involvement spans around 12% of clubs across Europe’s top five leagues, with a strategic focus that often extends beyond top-tier teams.

Source: Football Benchmark Ownership Database

Recently promoted Ipswich Town serves as a recent example of private equity’s engagement at the lower levels of the football pyramid. In 2021, ORG, a U.S.-based investment fund, acquired a majority stake, choosing to concentrate on off-field improvements rather than direct on-pitch involvement. This approach proved successful: Ipswich earned back-to-back promotions and has reached EPL status for the first time since 2002, something that significantly boosted the club’s valuation.

Funds like Arctos, which hold stakes in PSG, Atalanta and Liverpool, adopt strategies focused on enhancing commercial opportunities while refraining from on-field decision-making. Their goal is to invest in clubs with low relegation risk, ensuring stability and potential for steady returns.

Private equity firms have different approaches based on ownership levels. Majority ownership, as seen in Clearlake Capital’s acquisition of Chelsea FC, provides the latitude for direct management, while minority stakes, such as Silver Lake’s investment in Manchester City, allow firms to operate more like silent partners. This range of involvement showcases the diversity of strategies private equity employs when entering the football market.

Private Equity & leagues: Institutional investment in football

Private equity’s influence extends beyond clubs, reaching institutions like leagues that offer additional evidence of its varied approach. Over the past few years, four of Europe’s big five leagues have sought outside investment, with Spain’s La Liga and France’s Ligue de Football Professionnel (LFP) securing deals with CVC Capital Partners. However, attempts in Germany’s Bundesliga and Italy’s Serie A failed to gain similar traction mainly due to internal resistance from fans and a failure of clubs collectively agreeing a deal, respectively.

For example, La Liga’s partnership with CVC provides the league’s clubs with EUR 1.9 billion in funding, in exchange for 8.25% of La Liga’s audiovisual rights for 50 years. This capital aims to help clubs accelerate investment plans, with at least 70% of the funds allocated to infrastructure, technological innovation and international expansion. Meanwhile, France’s LFP secured a EUR 1.5 billion investment from CVC for a 13% stake in its commercial arm. While intended for league-wide transformation, these funds have largely been used to address operational needs, underscoring the financial challenges leagues face and the need for sustainable investment.

The bigger picture: Private Equity’s diverse investments in global sports

Private equity’s interest in sports extends well beyond football, with partnerships and investments spanning sports such as motor racing, cricket and U.S. professional leagues. CVC Capital Partners, for instance, has maintained a long-standing presence in motorsports, with investments in MotoGP and Formula 1. After acquiring MotoGP in 1998, CVC achieved significant returns, increasing its original EUR 71.5 million investment to EUR 525 million. In Formula 1, their involvement saw its investment grow from an estimated EUR 2 billion to EUR 8 billion upon exit.

Private equity has also influenced cricket, with top firms investing in the Indian Premier League (IPL). RedBird Capital Partners, CVC Capital Partners and Tiger Global are among the firms that have contributed to the IPL’s valuation growth, which reached nearly USD 11 billion in 2023, reflecting an 88% post-pandemic increase since 2019. Similarly, U.S. sports leagues like the NBA, MLB and NFL have opened up to private equity ownership, with firms like Arctos Sports Capital and Sixth Street Partners acquiring stakes in franchises such as the San Antonio Spurs and Golden State Warriors.

These investments show private equity’s expanding footprint across global sports, with European football representing only one part of a much larger strategy.

Conclusions: A complex role in football’s future

Private equity’s involvement in football is not without controversy. German fans’ protests against a proposed CVC investment in the Bundesliga, marked by banners and interrupted matches, reflect fans’ deep-seated concerns over corporate influence in a sport with strong local ties. Football clubs hold a unique place in their communities, and their connection to fans transcends the typical investor-stakeholder relationship.

While private equity investments in football have been underpinned by rising media rights, recent trends indicate that this source of revenues in major leagues has plateaued, presenting unexpected headwinds. This shift adds complexity to the investment landscape, as media rights may no longer offer the growth trajectory they once did. Furthermore, private equity firms tend to prefer active management, yet they often face challenges within football’s intricate and fragmented governance structures. Unless these structures adapt to facilitate more strategic decision-making, they may become a significant barrier to private equity’s growth and impact within the sport.

Despite these challenges, private equity’s impact on football is undeniable. Still in its early stages, it has already become a dynamic and multifaceted force within the industry. By providing vital capital, aiding clubs’ recovery post-pandemic, and supporting strategic initiatives, private equity could play a significant role in securing the long-term future of European football. However, its presence will likely continue to spark debate about balancing financial gain with football’s cultural heritage, framing an intriguing and potentially transformative future for the sport.