Article written by Football Benchmark

Over the past decade, the term “Big 6” has become central to discourse around the Premier League. Arsenal, Chelsea, Liverpool, Manchester City, Manchester United, and Tottenham Hotspur have been the sporting and financial powerhouses of a league that is itself the global leader in club football. These clubs have dominated domestic performance, secured the majority of Champions League places, and built global commercial brands.

Yet the wider environment has shifted. The Premier League’s broadcast revenues have increased, giving even mid-ranking clubs levels of income far above their continental peers. This has enabled investment in infrastructure and talent, strengthening competitiveness beyond the established elite. At the same time, the introduction of Profitability and Sustainability Rules (PSR) has placed greater emphasis on sustainable models, and the expansion of UEFA competitions has further opened up access to revenue streams once reserved mainly for the elite.

Against this backdrop, ambitious challengers have emerged. Historic names such as Newcastle United, Aston Villa, and Everton have sought to reposition themselves near the top, while newer forces like Brighton & Hove Albion, Brentford, and Bournemouth continue to punch above their weight. Their progress has raised questions about whether the long-standing dominance of the Big 6 is as secure as in the past.

This analysis examines league performance, European qualifications, revenues, and squad values to assess the extent to which challengers are reshaping the competitive landscape and whether their breakthroughs signal a lasting rebalancing or are episodic.

DOMESTIC AND EUROPEAN PERFORMANCE

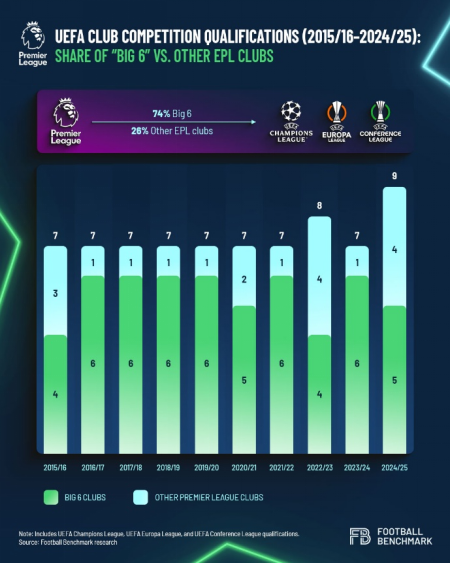

UEFA Club Competition qualification data provides a clear measure of how difficult it remains to break into the elite. Over the past decade, 17 different English clubs have reached European competitions, but concentration has stayed high: 74% of all places went to the Big 6. Access to the Champions League has been even more restricted, with 91% of qualifications secured by these clubs.

In the Champions League, at least three Big 6 clubs have qualified in every season over the past decade, with non-Big 6 entrants rare and usually short-lived, such as Leicester. Newcastle are a new exception, having begun to establish themselves as a more regular fixture in recent years. By contrast, the Europa League and the recently created Conference League offer challenger clubs the opportunity to benefit from recurring exposure to income associated with international competitions.

League performance reflects a similar pattern. While the Big 6 have not had a monopoly on the domestic top six, with at least one outsider breaking in during six of the past ten seasons, very few challengers have been able to consolidate their position. Leicester’s rise remains the most dramatic case: Premier League champions in 2015/16, followed by two Europa League qualifications, before a sharp decline that ended in two relegations within a couple of years.

These trends indicate that, while the Premier League table has become more volatile and more clubs are gaining occasional access to Europe, consistent participation in the Champions League remains the defining marker of elite status, and one that is still largely controlled by the Big 6.

REVENUES AND REACH

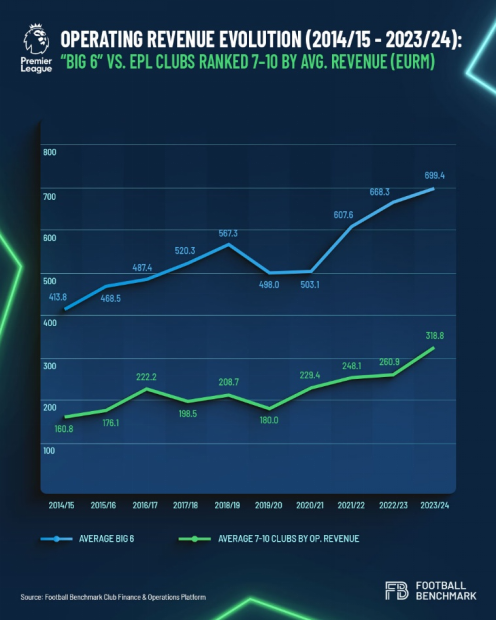

Between 2014/15 and 2023/24, the average operating revenues of the Big 6 increased by 69% to just under €700 million, equating to an average rise of €286 million per club. The group of clubs ranked 7th–10th by revenue almost doubled their average income, with a growth of 98%, but in absolute terms, this amounted to a smaller increase of €158 million. In other words, while challengers have grown faster in percentage terms, the financial gap has not necessarily narrowed.

The Big 6’s dominance is rooted in the scale and balance of their income streams. Over the same period, their commercial revenues grew by an average of €155 million per club (+93%), broadcasting by €96 million (+61%), and matchday by €34 million (+38%). For the 7–10 group, the picture is different. Broadcasting was the main contributor to growth, adding €97 million per club (+92%), while commercial rose by €44 million (+158%) and matchday by only €17 million (+61%).

In 2023/24, the average Big 6 club generated €322 million in commercial income, €255 million from broadcasting, and €123 million from matchday revenue, compared with €72 million, €203 million, and €44 million, respectively, for the 7–10 group. These figures show the scale of the divide across revenue streams.

This contrast highlights structural strengths: for the Big 6, growth is anchored in commercial scale, reflecting their status as global brands. For the challengers, growth has been fuelled more by broadcasting, which itself is showing signs of plateauing, while matchday remains, for most, capped by stadium size. Despite more frequent European participation, the commercial gap is the hardest to close and emphasises the financial gap between the groups.

This resilience is most evident when looking at clubs whose on-pitch struggles might suggest a weakening grip. Manchester United, Tottenham, and Chelsea have all experienced inconsistent sporting results in recent seasons, feeding perceptions of a less dominant Big 6. The financial reality tells another story. United, for example, reported record revenues of £666.5m in 2024/25 despite a turbulent campaign, with commercial income now accounting for more than half of the total. This demonstrates how the largest brands can continue to sustain financial performance even in periods of on-pitch underperformance, underlining why the gap with challengers remains so difficult to close.

Social media trends reinforce this divide. Manchester United remain far ahead with more than 231 million followers across major platforms, while Manchester City, Liverpool, Chelsea, Arsenal, and Tottenham all exceed 110 million.

Challengers remain far smaller in scale, despite impressive growth rates. Newcastle’s following has risen by 160% since January 2022, while Aston Villa and West Ham have each more than doubled their audiences. Nottingham Forest (+440%), Brighton (+419%), and Brentford (+249%) have grown even faster from smaller bases. Yet these numbers underline the challenge: despite rapid growth, challengers remain far behind in global visibility, and with it the commercial income potential that flows from scale.

SQUAD VALUE GROWTH

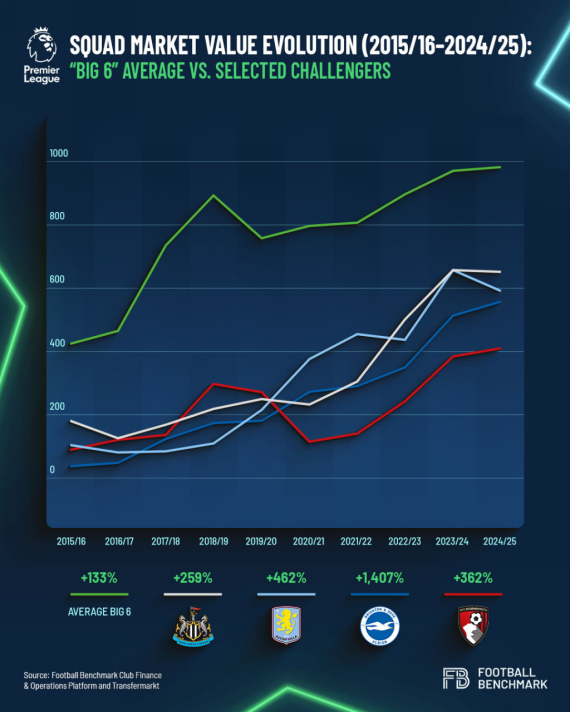

Rising revenues have allowed clubs outside the traditional elite to invest more heavily in their squads, a process that today remains closely tied to financial scale and regulatory limits. Newcastle’s ownership has supported major investment in quality players, culminating in the 2024/25 season when their squad valuation overtook Manchester United’s. Aston Villa are not far behind, with a strong sporting model and investment across the club helping them to close much of the gap. Other challengers, such as Brighton and Brentford, have sought to build models based on the identification, development and trading of talent, with reinvestment sustaining competitiveness.

Yet squad value growth must also be considered within the framework of PSR. The most prominent challengers referred to in this article – e.g. Everton, Aston Villa, Newcastle, Nottingham, and Leicester – have all faced PSR-related challenges in recent seasons, confirming how the commercial revenue gap with the Big 6 limits their ability to compete.

In this context, many have opted to follow a multi-club ownership (MCO) strategy – e.g. Aston Villa, Nottingham Forest, Leicester, Everton, and Bournemouth – as productive talent pipelines are considered the most efficient way to compete in the short- and mid-term.

A MORE OPEN PREAMIER LEAGUE, BUT ENTRENCHED DOMINANCE

The past decade has shown that challengers to the Big 6 come in different forms: historic clubs like Aston Villa and Newcastle repositioning themselves near the top, and newer forces such as Brighton, Brentford, and Bournemouth building models to compete at higher levels.

The gap is narrowing in sporting terms, with more clubs breaking into the top six and qualifying for Europe. But financially, the Big 6 remain entrenched, with their scale in revenues, commercial power, and global reach continuing to underpin long-term dominance.

The question is whether the recent progress of challenger clubs marks the start of a rebalancing or echoes past episodic breakthroughs. Sustained sporting results can reshape the hierarchy over time, while setbacks can undermine even the biggest clubs. Ultimately, financial and sporting performance remain inseparable, and only consistent results can drive lasting change.

Football Benchmark supports clubs and investors in navigating this environment, combining market intelligence, expertise, and bespoke advisory to guide decision-making in one of football’s most competitive markets. Our deep understanding of the league’s unique environment and evolving dynamics enables stakeholders to identify opportunities and adapt strategies in a shifting landscape.

By Football Benchmark

Breaking into the Premier League’s “Big 6”: Are challengers changing the competitive landscape on and off the pitch?

Article written by Football Benchmark Over the past decade, the term “Big 6” has become central to discourse around the Premier League. Arsenal, Chelsea, Liverpool, Manchester City, Manchester United, and Tottenham Hotspur have been the sporting and financial powerhouses of a league that is itself the global leader in club football. These clubs have dominated domestic performance, secured the majority of Champions League places, and built global commercial brands. Yet the wider environment has shifted. The Premier League’s broadcast revenues have increased,

Heat and climate change in the 2025 summer of sport

Extreme temperatures defined the summer 2025 events, prompting heat safety measures for both players and fans. Hydration strategies helped reduce health risks. Prioritizing both sustainability and safety, organizers promoted water refilling stations and minimized plastic waste while ensuring the wellbeing of spectators. As climate change drives temperatures higher, extreme heat is becoming a defining challenge for the world of sports. The summer of 2025 showcased just how disruptive soaring temperatures can be, affecting athletes’ performance, fan safety, and event operations alike. At Wimbledon 2025, temperatures climbed to an uncomfortable 32–34°C during the first

AWS and SFS: a strategic partnership to revolutionize the future of football

We are proud to announce Amazon Web Services (AWS) as Main Partner of the Social Football Summit 25 (SFS 25), the leading international event for the football industry, taking place on 18–19 November at the Allianz Stadium in Turin. This strategic partnership marks a crucial step for innovation in the football sector. AWS, the global leader in cloud computing, will bring its powerful ecosystem of cutting-edge technologies — from cloud and artificial intelligence to advanced data analytics solutions — to transform the modern

Who leads Europe’s clubs? CEO profiles and pathways across the “Big Five” Leagues

Modern football is shaped as much in the boardroom as on the pitch. At the centre of this transformation is the Chief Executive Officer (CEO), the figure tasked with steering clubs through the complexities of global finance, commercial growth, and sporting ambition. Once dominated by chairmen or part-time directors, club leadership has professionalised, and the CEO role has become central to how ownership vision is translated into day-to-day action and long-term strategy.Following our recent analysis of Sporting Directors, this research

Profitability in football: Lessons from Europe’s most profitable clubs

Article written by Football Benchmark European club football has enjoyed strong revenue growth over the past decades, driven by expanding competitions, internationalisation, and commercial innovation. Yet recent years have tested this trajectory. The COVID-19 pandemic disrupted operations, while ongoing shifts in the media landscape continue to put pressure on historically reliable income streams. In parallel, regulatory frameworks have increasingly prioritised financial sustainability, reshaping the operating environment for clubs across the continent. Despite rising revenues, there remains a widespread perception that football

UEFA Club Competition reforms over the years: Analysing the impact on clubs in small and medium-sized markets

Article written by Football Benchmark UEFA Club Competitions (UCC) are widely regarded as the pinnacle of club football. For most clubs, however, participation on this stage is anything but guaranteed and often celebrated as a landmark achievement. Automatic access to the UEFA Champions League (UCL) league phase is restricted to the top ten leagues by UEFA’s country coefficient. However, the remaining 45 nations, home to nearly 200 million people, are a fundamental component of European club football, providing diversity, depth,

Atlético de Madrid’s transformation: A decade of capital, competitiveness, and global reach

Article by Yossi Segal & Márton Ferencz | Football Benchmark Over the past decade, Atlético de Madrid has redefined its position in European football. On the pitch, the team has become a regular fixture in the UEFA Champions League and has consistently challenged Spain’s two giants for domestic honours. Under Diego Simeone's stewardship, Atlético has reached two Champions League finals, won La Liga in 2014 and 2021, and lifted the UEFA Europa League and Super Cup, cementing its reputation on the

Online hate speech in sports: an increasingly urgent challenge

Article written by Enovation Consulting From racism against football players to prejudice towards women: how sports organizations are trying to address a growing phenomenon. In recent years, with the widespread rise of social media, online hate speech has become an increasingly concerning issue, particularly in the world of sports. Digital platforms like Twitter, Instagram, and TikTok have revolutionized the way fans engage with athletes and sporting events. These platforms have helped bridge the gap between athletes and supporters, creating opportunities for connection, inspiration, and real-time

The changing face of transfer spending: What the most expensive deals reveal about how elite clubs are aligning fees with revenues and player value

Article written by Football Benchmark Each summer, transfer speculation dominates football discourse, often attracting more attention than what happens on the pitch during the season. But behind the excitement of who a club’s next Galáctico might be, a clear shift has taken place in how elite clubs approach transfer spending. Over the past 15 years, there has been a move away from speculative, unbalanced deals towards more disciplined, revenue-aligned investment. While headline fees remain high, they increasingly reflect a club’s financial capacity and

MAPPING SPORTING DIRECTORS: FOOTBALL DECISION-MAKER TRENDS ACROSS EUROPE’S “BIG FIVE” LEAGUES

Article written by Football Benchmark Sporting Directors have become increasingly visible in the discourse surrounding the summer transfer window, a period when their work moves into the spotlight. But their role extends far beyond player transfers. From squad building and recruitment to managing the academy pipeline and setting long-term sporting direction, Sporting Directors are now central to how clubs operate year-round. Seen as the strategic anchor of a club’s football department, they are expected to focus on long-term planning and sporting coherence. Yet