Analysis by Football Benchmark

1. Portugal boasts a strong player development ecosystem, with elite academies consistently producing high-value talent that moves to Europe’s top leagues.

2. The country’s historical and linguistic ties to some areas of South America and Africa provide a competitive edge in scouting and integrating emerging talent.

3. Favourable regulations, including unrestricted recruitment of non-EU players, enhance Portugal’s appeal as a key market for international talent development.

4. The relatively low acquisition costs of Portuguese clubs, coupled with expected revenue growth from upcoming broadcasting centralization, present strong long- term investment potential.

5. However, rising MCO and investor interest may intensify competition, making it more challenging to secure attractive club acquisitions. MCO landscape overview

MCO landscape overview

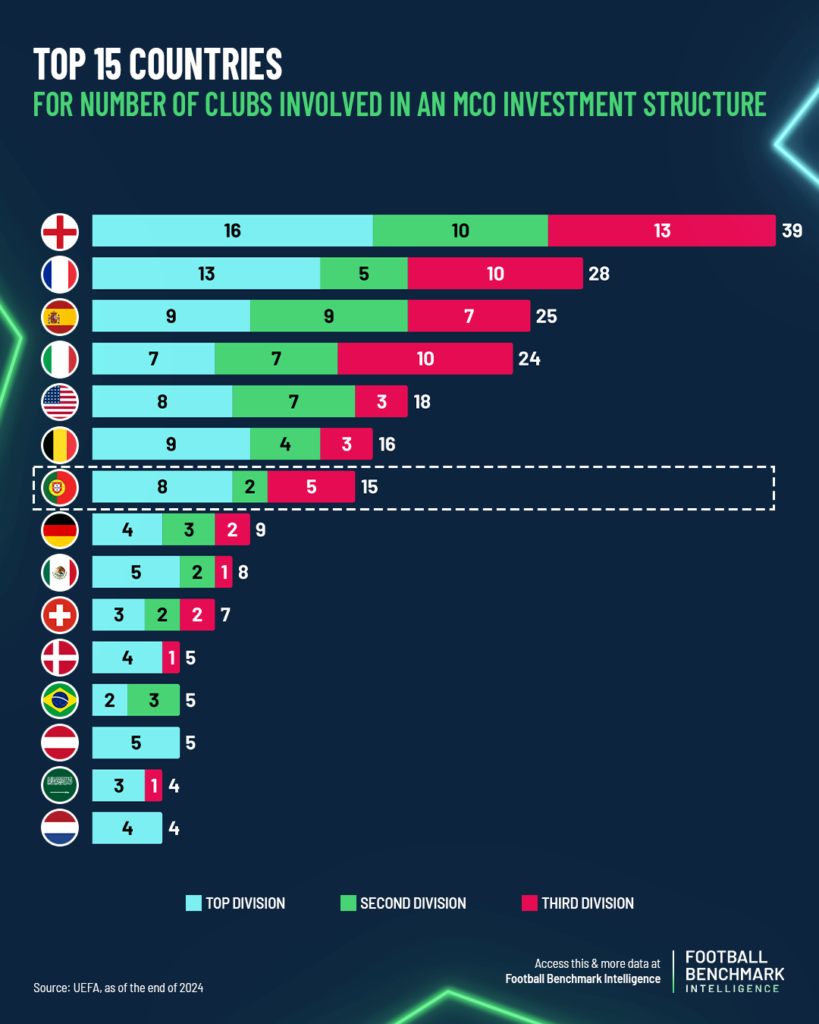

The concept of Multi-Club Ownership (MCO), where a single investor or group holds stakes in multiple football clubs, has become an increasingly prevalent investment strategy in today’s global football industry. Clubs within an MCO can gain competitive advantages by leveraging shared resources for talent development and commercial synergies. According to UEFA, 342 clubs worldwide are currently part of an MCO, compared to fewer than 60 a decade ago.

MCOs are primarily concentrated in the wealthiest leagues, particularly in Europe’s Big Five markets. Outside of these top leagues, the USA, Belgium and Portugal have the highest number of clubs involved in MCOs. This week’s article focuses on the Portuguese market, one of the most attractive environments for investors, due to its strong player development ecosystem, appealing financial entry points and a business-friendly regulatory framework.

Why Portugal? Key factors driving investor interest

– Talent development hub

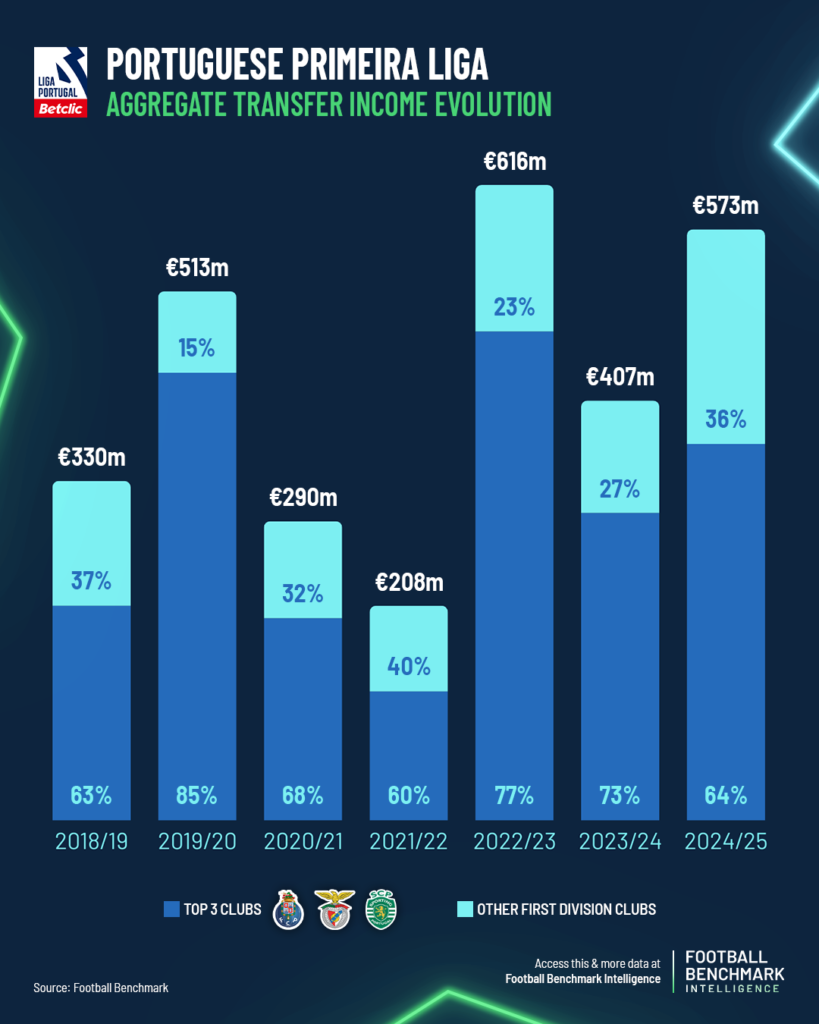

Portugal has built a global reputation as a football talent factory, consistently ranking among the top nations for player exports. Clubs like Benfica, Sporting CP and FC Porto have established world-class youth academies that produce elite players, many of whom move to Europe’s top leagues for substantial transfer fees. Between the 2018/19 and 2024/25 seasons, a quarter of all outgoing transfers to clubs outside Portugal were directed to the Big Five leagues, with an average transfer fee of EUR 11.2m. Among these, La Liga was the most frequent destination (7% of total transfers), while the English Premier League clubs paid on average the highest fee at EUR 22.7m. Over the past seven seasons, the total transfer income generated by the 18 Primeira Liga clubs has consistently exceeded EUR 400 million per season, except during the Covid- impacted seasons, peaking at EUR 616m in 2022/23. However, it is important to highlight that 70% of this income, on average, was generated by Portugal’s top three clubs, SL Benfica, FC Porto and Sporting CP (“the Big Three”).

The five most lucrative transfers recorded by Portuguese clubs during this period were all completed by SL Benfica: João Félix (EUR 127m), Enzo Fernández (EUR 121m), Darwin Núñez (EUR 80m), Rúben Dias (EUR 80m) and Gonçalo Ramos (EUR 65m). Outside the Big Three, the most valuable transfers were Shoya Nakajima from Portimonense SC to Al-Duhail SC for EUR 35m in 2018/19, as well as Vitinha (EUR 32m) and Trincão (EUR 31m), who moved from SC Braga to Olympique de Marseille and FC Barcelona, respectively. Portugal’s Big Three dominate the country’s talent market, creating a challenging environment for investments in smaller clubs. Investors who want to enter the Portuguese market, especially MCOs aiming to capitalize on player recruitment and development, will need to navigate this landscape strategically and identify opportunities to carve out a niche within the country’s deep talent pool.

– A gateway to Latin American and African markets

Portugal maintains strong historical, cultural and linguistic ties with countries that are part of the CPLP (Community of Portuguese Language Countries), such as Brazil, Angola, Mozambique, Cape Verde and Guinea-Bissau. This offers a significant advantage in recruiting and transferring emerging talent from these regions, and MCOs can use Portuguese clubs as steppingstones for integrating South American and African players into European football.

Evidence of this can be seen by analysing the current squads of Primeira Liga clubs, focusing on players who have accumulated a combined total of 450+ minutes played over the past 365 days. Brazilian players are by far the second most represented nationality, making up 18% of the total number of players in clubs currently competing in the Primeira Liga. Additionally, players from Cape Verde and Angola also feature among the top 10 most represented nationalities. A further clear indication of the strong connection between the Portuguese and Brazilian markets can be seen in the breakdown of outgoing transfers from Brasileirão clubs over the past seven seasons. The Primeira Liga is the most frequent destination, accounting for 13% of total outgoing transfers to non-Brazilian clubs. La Liga Portugal 2 is also among the most frequent destinations, at 4%. For context, the most frequent destination among the Big Five leagues is the English Premier League (at just 3%). It’s also interesting to compare the average fee paid for players transferred from Brazil to Portuguese clubs versus those paid by Big Five clubs: EUR 1.5m vs EUR 10.6m. Theoretically, this difference represents a segment of the player development value chain that an MCO’s flagship club could potentially internalize by investing in a Portuguese club.

– Favourable regulatory framework

In addition to the cultural and language advantages with certain countries, the Portuguese market also offers a regulatory environment that is highly favourable for player recruitment and development, making it an attractive destination for international talent. There are no restrictions on signing non-EU players, providing a significant competitive advantage compared to the Big Five leagues. In fact, non-EU players accounted for over 40% of the total playing time in the Primeira Liga over the past two seasons. Another important factor for potential MCO establishments, especially regarding their player development strategy, is the absence of restrictions on B teams, other than the requirement that they cannot compete in the same division as their parent club’s first team. This provides relevant additional playing opportunities for young talents.

– Lower initial investment and higher return expectations

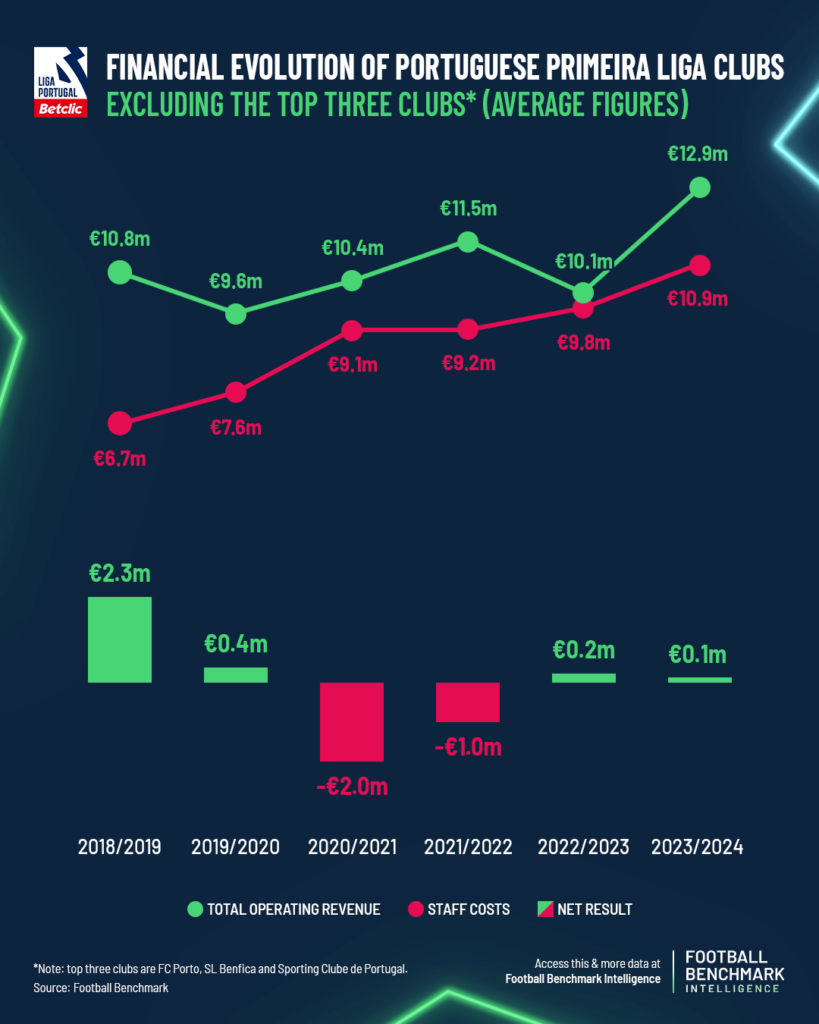

Compared to saturated, high-cost markets, Portuguese clubs offer an opportunity for lower initial investments with higher potential returns. Investors can acquire lower division or mid table Primeira Liga clubs at competitive prices. With a relatively small investment in both the acquisition and club development, talent development can be leveraged as a primary revenue stream and as a key competitive advantage for a flagship club, particularly in the case of an MCO investment. Focusing on the current economic performance, excluding the top three Portuguese clubs which regularly compete in European competitions and generate average revenues above EUR 100m, the remaining Primeira Liga clubs have recorded average revenues ranging from EUR 9.6m to EUR 12.9m over the past six seasons. In contrast, second-division clubs report significantly lower revenues, with averages ranging between EUR 2m and EUR 4m, based on the latest available data. In the same timeframe, staff costs for first-division clubs, excluding the Big Three, have steadily increased, reaching a record EUR 10.9m, but they have always remained below revenue levels. As a result, except for the COVID-impacted seasons, average profitability has consistently been positive or close to the break-even over the past six seasons. These current revenue levels, relatively low compared to other major European leagues, could lead to higher returns in the medium to long term, thanks to the untapped revenue growth potential within the Primeira Liga. Specifically, the centralization of broadcasting rights announced for the 2027/28 season is expected to yield increased payouts to mid- and smaller-sized clubs, thereby improving overall competitive balance. While some top clubs remain hesitant, this move could boost international visibility and strengthen financial stability across the whole league. Additionally, Portuguese clubs are currently guaranteed at least five spots in European competitions through the league and the domestic cup. While the first three slots are most of the time out of reach, a relatively small investment in a mid-table club could allow to compete for a spot in the UEFA Europa League or Conference League. Qualification for the final stages of a UEFA competition could bring substantial benefits, with prize money in some cases nearly doubling the club’s total turnover.

– Foreign investments in Portugal

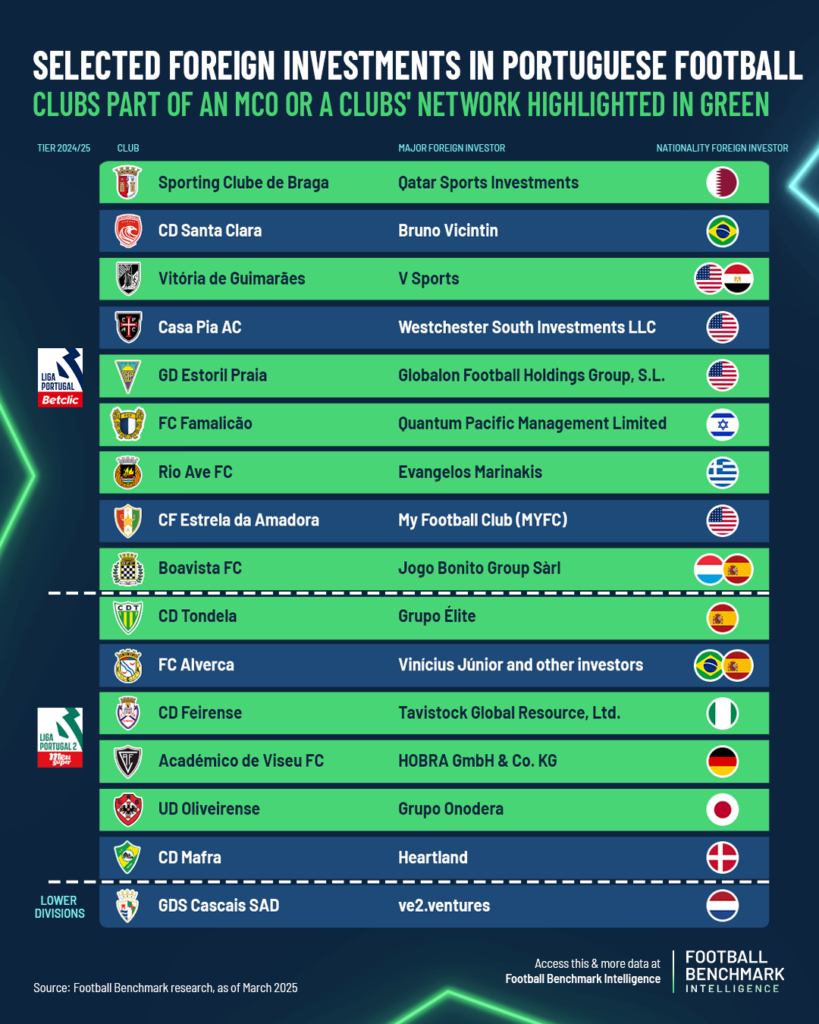

For the reasons stated above, Portuguese clubs have welcomed several foreign investors in recent years, coming from various countries and backgrounds. However, not many elite clubs have truly benefited from the establishment of a multi club ownership structure in Portugal. Among the exceptions are the two UEFA Champions League quarterfinalists that will face each other in April, Paris Saint Germain FC and Aston Villa FC, which are connected to Sporting Clube de Braga and Vitória de Guimarães, respectively. The only other Big Five clubs involved in a multi club ownership structure or otherwise linked to a Portuguese club are Atlético de Madrid with FC Famalicão, Nottingham Forest FC with Rio Ave FC, Crystal Palace FC and FC Augsburg with GD Estoril Praia and TSG 1899 Hoffenheim with Académico de Viseu FC. On the other hand, interest from Big Five clubs in the Portuguese market is growing, with rumours linking Chelsea FC, AFC Bournemouth, RC Celta de Vigo and also Eagle Group, among others, to potential acquisitions in Portugal. Two of the most recent takeovers of Portuguese clubs by foreign investors include CD Tondela, purchased by Grupo Élite, owners of Spanish second division club Racing Club de Ferrol, and FC Alverca, acquired by Real Madrid superstar Vinícius Júnior along with other Spanish investors. Both clubs currently compete in Portugal’s second division and are fighting for promotion to the topflight. The list of Primeira Liga clubs welcoming foreign investment also includes CD Santa Clara, controlled by Brazilian entrepreneur Bruno Vicintin; Casa Pia AC, owned by the Platek family, who previously owned two other football clubs, Sønderjyske in Denmark and Spezia Calcio in Italy, and is currently in negotiations to acquire Reading FC; CF Estrela de Amadora, which counts former player Patrice Evra among its shareholders; and Boavista FC, controlled by Luxembourgish Spanish businessman Gérard López.

– Key conclusions

In conclusion, Portugal’s football market is highly attractive for investors and MCOs due to its strong player development system, relatively low acquisition costs and favourable regulations. From a financial perspective, investing in a Portuguese club requires significantly less capital than entering other primary European markets, while still offering substantial potential returns. Specifically, the centralization of broadcasting rights in 2027/28 and the guaranteed five European competition spots create potential for revenue growth. However, the latter also poses challenges to be carefully assessed, due to UEFA’s restrictions on clubs with shared ownership competing in the same European competition. Investors must also navigate legal structures, as Portuguese clubs operate under either an SAD (Sociedade Anónima Desportiva), which allows private investment, or an SDUQ (Sociedade Desportiva Unipessoal por Quotas), which restricts external ownership. Understanding these structures is crucial when considering an acquisition. While Portugal remains a cost-effective and strategically advantageous market for MCO expansion, rising investor interest could soon intensify competition and limit the availability of attractive club targets. To maximize success, potential investors should clearly define their strategic objectives before entering the market. For those seeking tailored insights and data-driven guidance, the Football Benchmark Team is well-positioned to support clubs and investors in evaluating the best opportunities within Portuguese football.

Investing in Portuguese football: a prime spot for Multi-ClubOwnership?

Analysis by Football Benchmark 1. Portugal boasts a strong player development ecosystem, with elite academies consistently producing high-value talent that moves to Europe’s top leagues.2. The country’s historical and linguistic ties to some areas of South America and Africa provide a competitive edge in scouting and integrating emerging talent.3. Favourable regulations, including unrestricted recruitment of non-EU players, enhance Portugal’s appeal as a key market for international talent development.4. The relatively low acquisition costs of Portuguese clubs, coupled with expected revenue growth

Stadium Business – Strategies to optimize matchday revenues

For decades, matchday revenue has been a cornerstone of football club finances, alongside broadcasting and commercial income. However, new fan engagement trends and technological advancements are challenging traditional ticketing models. Clubs must now adapt to a rapidly changing landscape where fan expectations, digital innovation, and commercial pressures require a more dynamic, data-driven approach to stadium monetization. In this article, we explore some of the strategies football clubs are implementing to maximize their matchday revenues. Defining matchday revenues Before the analysis, it is

SFS SNACK BRUSSELS – Football and Europe: rules, rights and priority

In the prestigious setting of the European Parliament, a symbolic venue for decisions that shape the future of Europe, on 26 March from 16.30 to 18.30 the SFS Snack Brussels, entitled "Football and Europe: rules, rights and priority",presents itself as a key event for debating the governance of European football. At a time of profound regulatory transformations and global challenges, this event offers a unique opportunity to bring together institutions, experts, and key industry players to outline effective strategies for

Game changers: a snapshot of the top 100 most valuable players

Following the conclusion of the winter transfer window, the latest update of the Football Benchmark Player Valuation Tool has reassessed the market value of over 10,000 players worldwide. This powerful tool, designed for clubs, agents and football governing bodies, provides an objective, data-driven valuation based on key factors such as performance metrics, contract details, age, and broader market trends. It is important to note that a player's market valuation reflects the estimated worth of their current contracts rather than a

Breaking down the record-high expenditure in the winter transfer window

After a summer window that saw a 10% drop in spending, the winter window increased by 8% compared to last season, reaching EUR 1.46 billion. As a result, the total transfer expenditure (summer + winter windows) across top-division UEFA leagues and the English Championship shows a 4% overall drop compared to last season reaching EUR 7.87 bn in 2024/25. This represents a slight decline in expenditure for the first time since the pandemic. With the transfer window now closed for

The Business of Football Academies: How Clubs Create Value from Youth Development?

Key insights:- The evolution of Academy players: From "one-club" legends to strategic assets: Academy players are increasingly viewed as commodities rather than potential club legends, becoming integral components of financial strategies and accounting practices. Despite this shift, the role of academies is more significant than ever, as a well-executed youth development strategy can have substantial impact.- Tailoring the Academy vision to club context: There is no universally correct approach to academy development; the most suitable vision depends on each club’s

Private Equity’s expanding footprint in football: Risks, rewards and the future

Brief Overview Private equity’s role in football has grown significantly, with investments spanning clubs, leagues and sports institutions worldwide. Driven by football’s global appeal and potential for sustained revenue, private equity firms are reshaping the industry, from financial recovery efforts post-COVID to strategic modernization initiatives. While they offer stability and growth, these investments also raise questions about the balance between commercial gains and the sport's cultural roots. Key insights: Football’s global appeal fuels investment: Football's unmatched global reach and loyal fan base

The FIFA Club World Cup, a packed calendar, and a tv offer that cannibalizes football

The venues have finally been confirmed: FIFA has revealed the 12 U.S. stadiums that will host the expanded 32-team Club World Cup from June 15 to July 13, 2025. But the real question clubs are asking is: where is the money coming from? Interview with Andrea Sartori by Marco Iaria | La Gazzetta dello Sport Following an emergency meeting with broadcasters called by president Infantino, uncertainty still looms. What we do know is that, initially, FIFA's president hoped to generate $4 billion,

Priceless potential: The soaring value of young footballers

With the 2024/25 summer transfer window recently closed, we have updated the valuations of over 10,000 players on our platform. This analysis highlights key insights from the new market values, offering a deeper understanding of how player values and squad compositions are shifting. It also provides a picture of which teams are poised for success this season and where the most promising young talent can be found, particularly in leagues outside the traditional powerhouses. Key findings Mbappé, Haaland, and Bellingham are the

Beyond glory: Analysing Manchester United’s financial health in the post-Ferguson era

Manchester United FC are one of the most well-known names in football history with a global fan base that can rival any other. However, instead of a string of successes, most headlines about the club in recent years have been about their struggles both on and off the pitch. The recent partial takeover by Sir Jim Ratcliffe promises a turnaround, but what challenges are they facing exactly? With the help of Football Benchmark data & analysis, let’s explore the financial