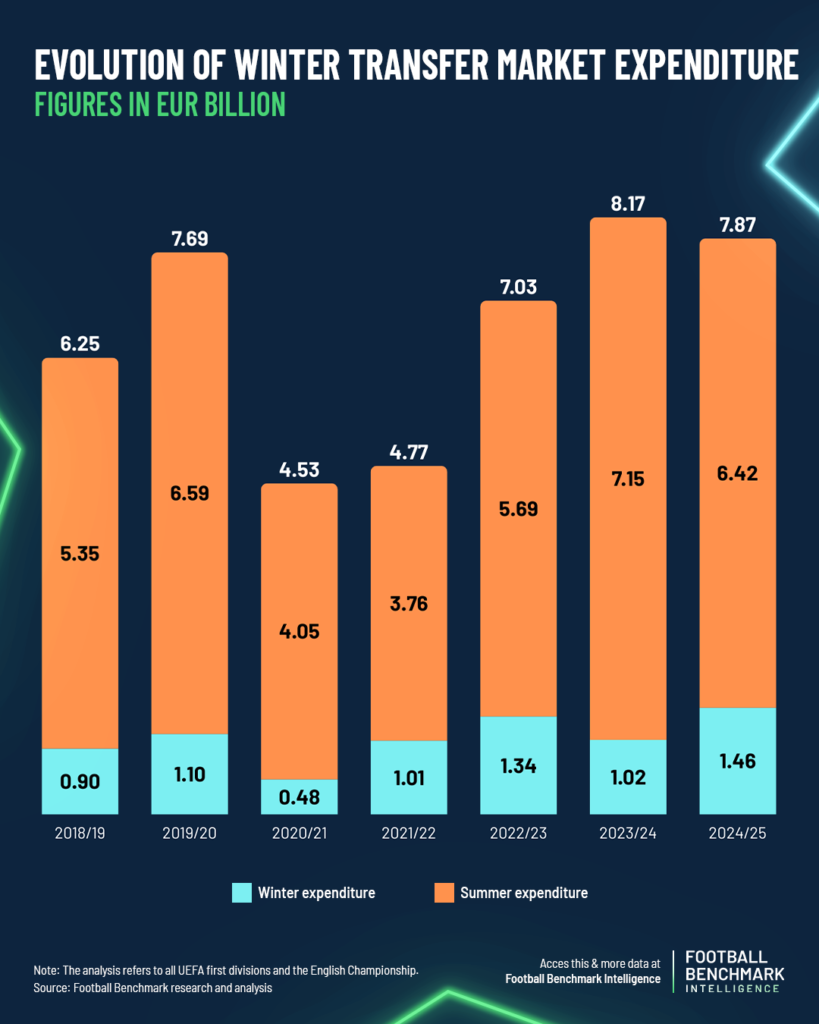

After a summer window that saw a 10% drop in spending, the winter window increased by 8% compared to last season, reaching EUR 1.46 billion. As a result, the total transfer expenditure (summer + winter windows) across top-division UEFA leagues and the English Championship shows a 4% overall drop compared to last season reaching EUR 7.87 bn in 2024/25. This represents a slight decline in expenditure for the first time since the pandemic. With the transfer window now closed for the top leagues, this article breaks down the latest trends, highlighting which leagues and clubs spent the most and where the most expensive players landed this winter. Before diving into the analysis, this article reviews the transfer activity of UEFA’s top divisions and the English Championship during the 2024/25 winter window. It focuses exclusively on permanent, fee-paying transfers, excluding loans and free transfers. All data reflects completed

deals as of February 4, 2025.

Key insights:

1)Winter transfer expenditure hit a seven-year high, reaching EUR 1.46 billion across UEFA’s top divisions and the English Championship.

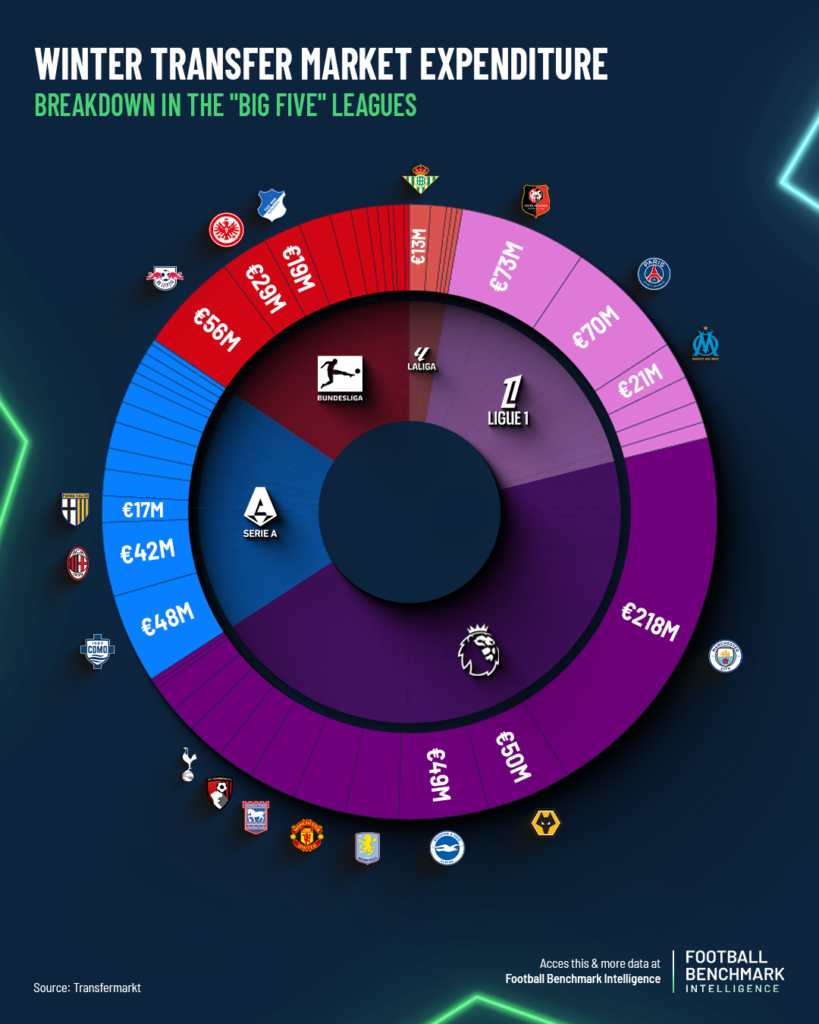

2)Manchester City scored the second-highest winter spend in history (EUR 218m), just behind Chelsea FC’s record-breaking spree in 2023.

3)Top clubs did not dominate this winter transfer window, as several emerging actors such as Stade Rennais (EUR 73m) and Como (EUR 48m) took center stage in terms of expenditure.

A record high spending for a winter transfer window

Historically, winter spending accounted for just 15-20% of summer activity in the selected leagues on aggregate. This is largely because clubs are hesitant to make major squad changes during the season unless forced by injuries, poor form, or unexpected opportunities. The shorter window and its limited time for new signings to integrate or overspending during the summer further contribute to a more cautious approach compared to the summer market.

During this winter transfer window, the expenditure reached EUR 1.46 bn in UEFA first divisions and the English Championship. This represents the highest winter spending in seven seasons, aligning with historical averages as winter spending reached 17% of summer expenditure. The total figure even surpasses the 2022/23 winter window following the FIFA World Cup when Chelsea FC alone spent over EUR 300 million.

Usual suspects at league level and unexpected surprises at club level

From a league perspective, with a focus on the “Big Five”, the English Premier League confirms its financial dominance. The EPL stands out as the biggest spender in this winter window, with a total expenditure of EUR 484m, accounting for around 82% of the combined spending of the rest of the “Big Five” leagues, which reached EUR 593m. On the opposite side, LaLiga did not show much activity, recording only EUR 30m spend. The Spanish top division’s spending was even surpassed by the English Championship (EUR 92m), Portuguese Primeira Liga (EUR 52m), Turkish SüperLig (EUR 40m), Russian Premier League (EUR 36m) and the Belgian Pro League (EUR 32m). On the selling side, the French Ligue 1 leads the way generating EUR 270m in transfer income, followed by the Italian Serie A (EUR 166m), the English Premier League (EUR 149m), and the German Bundesliga (EUR 137m), all exceeding the 100 million marks. Taking all this into account, among the “Big Five” leagues both the French Ligue 1 (EUR 73m) and the Spanish LaLiga (EUR 25m) closed the window with a positive balance. Beyond the “Big Five” leagues, the Portuguese Primeira Liga solidified its net seller status, scoring EUR 188m in transfer market income and a positive net balance of EUR 136m. The Dutch Eredivisie followed, with nearly EUR 100m in sales, resulting in a positive balance of EUR 77m.

At the club level, Manchester City FC top the spending charts (EUR 218m), accounting for 45% of their league’s total outlay.

Their investment marks the second-highest winter spend in history, trailing only to Chelsea FC’s record-breaking spree in 2023. Overall, Manchester City FC were one of the most active clubs in the winter transfer window, with three of their signings ranking among the most notable deals (i.e.: Marmoush, Nico González, Khusanov). These transfers come at a crucial moment for the club, as they are navigating a challenging season both on and off the pitch. The Citizens’ reinforcements could prove crucial as the club seeks to regain momentum during a challenging season both on and off the pitch. However, it is worth mentioning that the other clubs among the English “Big Six” did not monopolize the transfer market during this winter window, with clubs like Wolverhampton, Brighton, Aston Villa emerging as significant players among top spenders. A similar trend is observed also in other leagues, where top clubs are lagging behind emerging clubs. For instance, this is the case with Stade Rennais FC, outpacing PSG with EUR 73m transfer market spend and leading their league in this regard. Despite a challenging season in the battle to avoid relegation, this is a testament to Pinault family’s willingness to maintain the club at the pinnacle of French football. Also in the Italian Serie A, newly promoted clubs like Como and Parma soared in terms of transfer market expenditure. Interestingly, Como were extremely active during this window, aiming at strengthening their squad with international caliber players to avoid relegation this season and lay the foundation for long-term success in the top-flight. Maxence Caqueret (EUR 15m), Anastasios Douvikas (EUR 13m), and Assane Diao (EUR 12m) stand out as their most significant investments during this window.

In terms of income, Aston Villa FC, Eintracht Frankfurt, and SSC Napoli round out the podium of top sellers in the “Big Five” leagues, largely driven by the sales of star players like Jhon Durán to Al-Nassr FC, Omar Marmoush to Manchester City FC, and Khvicha Kvaratskhelia to Paris Saint-Germain FC, among others. Expanding the scope beyond the “Big Five”, FC Porto nearly matched Aston Villa’s income, thanks to the high-profile departures of Nico González and Galeno, respectively to Manchester City and Al-Ahli.

Conclusion

Transfer market spending across UEFA’s top divisions reached a record high for a winter transfer window in the past seven seasons. From a league perspective, the Premier League reaffirmed its financial dominance. At the club level, beyond usual giants like Manchester City and Paris Saint-Germain, emerging clubs across Europe were key players in the market, with Stade Rennais and Como standing out in this regard. Meanwhile, the limited activity of the rest of the clubs, particularly the ones in La Liga, showed the effects of stricter financial regulations, leading to more cautious spending. Now that the window has concluded, it is time to see how these spending efforts translate into on-field success.

Article by Riccardo Greco | Football Benchmark

Breaking down the record-high expenditure in the winter transfer window

After a summer window that saw a 10% drop in spending, the winter window increased by 8% compared to last season, reaching EUR 1.46 billion. As a result, the total transfer expenditure (summer + winter windows) across top-division UEFA leagues and the English Championship shows a 4% overall drop compared to last season reaching EUR 7.87 bn in 2024/25. This represents a slight decline in expenditure for the first time since the pandemic. With the transfer window now closed for

Oxford United Delivered a Masterclass in Rebranding Its Visual Identity

The London-based agency LoveGunn collaborated with the club to design a new visual identity, aiming to merge its historical and cultural heritage with future commercial aspirations. The world's most prestigious university and a dynamic new partnership with the LoveGunn studio—Oxford United, a club competing in the Championship, has launched a rebranding initiative to expand its commercial strategy and reach a new audience. The Club's visual identity The visual project presented by LoveGunn draws inspiration from the city's historic architecture, referencing the spires of

The stadium of the future: business, technology, and relationships in an evolving ecosystem

The modern stadium is no longer just a simple arena dedicated to sports but a continuously evolving ecosystem capable of integrating business, entertainment, and relationships. This was the central theme of the panel at SFS organized by Infront, featuring experts such as Javier Doña (Senior Stadia and Sports Management Advisor – Grandstand JD), Rolando Favella (Udinese), Alessandro Giacomini (Infront), and Stefano Deantoni (Infront), key figures in the management and innovation of sports facilities. The discussion highlighted how stadiums have become true

SFS24, The value of female leadership football

The last panel of the second day of SFS, in collaboration with Fortune Italia, shed light on female leadership in sports, exploring experiences and strategies that have contributed to transforming the sector. In recent years, the role of women in football has become increasingly significant, with tangible progress yet still many challenges to overcome. The panel featured prominent figures from the Italian sports scene: Silvia Salis, Vice President of CONI, Milena Bertolini, former head coach of the Italian women's national team,

SFS24 REPORT: LET’S TALK NUMBERS!

Once again, SFS has established itself as an unmissable event for the football industry, attracting an ever-expanding B2B audience. 2024 has been a year of remarkable growth for the event, both in terms of participation and impact, cementing its position as one of the most authoritative platforms for networking and innovation in the sports industry. An incredible milestone, made possible by the 70+ partners who believed in this project! The Stadio Olimpico in Rome welcomed over 4,000 attendees, including professionals, managers, and

SFS INSIGHT: EXCLUSIVE INTERVIEW WITH LEANDRO PETERSEN

Leandro Petersen, Chief Marketing Officer of AFA (Selección Argentina de Fútbol), was one of the key figures at the SFS, where he shared his vision on the transformation of the Argentine Football Federation. In an exclusive interview recorded at the SFS studios, he delved into the pillars of AFA’s commercial growth, exploring how digital innovation, economic strategies, and global impact have reshaped Argentine football. Since joining the federation before the 2018 World Cup, Petersen has led a strategic transformation that has

Exclusive SFS24: the Serie A festival presented

During SFS24, Lorenzo Dallari (Editorial & Social Director of Lega Serie A) and Luigi De Siervo (CEO of Lega Serie A) presented the upcoming edition of the Serie A Festival, an event designed to bring Italy’s top football league closer to the general public. The festival offers a space for dialogue, discussion, and the celebration of football in all its facets. The event, created with the goal of showcasing Serie A in an innovative and accessible way, will take place from

Javier Tebas at SFS: the future of La Liga between financial fair play, piracy fight, and global growth

The president of LaLiga, interviewed by Sky Sport journalist Giorgia Cenni at SFS24, discussed economic sustainability, global expansion, and threats like online piracy, outlining the strategic vision for Spanish football. At SFS, Javier Tebas, the head of the Spanish league, provided a detailed overview of the challenges and opportunities facing Spanish football and, more broadly, the international football landscape. La Liga has long been a benchmark for sustainability and sporting success. Over the past ten years, Spanish teams have dominated on

AEK Athens FC: Football and Social Action for a Sustainable Future

Guided by its history and roots, AEK Athens FC has developed a social action plan that harnesses the unique power of football to raise awareness about major societal challenges and issues. With consistency and dedication, the Club organizes a range of initiatives designed to make a difference. AEK Athens FC has launched activities in several key areas: fighting racism and all forms of discrimination, promoting diversity, equality, and inclusion with full respect for human rights. Health and education, aiming to

SFS24: The Importance of Data in the Football Industry

The Changing World of Football Transfers Data Intervention, one of the most anticipated panels of the seventh edition of the SFS, offered an illuminating insight into the impact that artificial intelligence (AI) and data analysis are having on football, particularly in scouting and transfer processes. Some of the industry’s leading experts took the stage: Cenk Ergun, former Sporting Director of Galatasaray, Nicola Innocentin, CEO of Global Football Service, K. Tarkan Batgun, CEO of Comparisonator, and Steven Vanharen, Technical and Sporting Director