From Suning to Oaktree: analysing FC Internazionale’s financial evolution

Right after the celebrations of their 20th title and the much-coveted second star, FC Internazionale Milano saw a change in ownership with the American fund Oaktree Capital Management taking control of the club after the Chinese conglomerate Suning Group failed to repay a EUR 395m three-year loan to the US fund. This article explores the economic and financial evolution of the club under Suning’s ownership, which began in June 2016 when the Zhang family acquired a majority stake (68.6%) in FC Inter for approximately EUR 270 million.

On the pitch, during the eight years under Chinese ownership, FC Inter secured the Serie A title twice (2020/21 and 2023/24) and triumphed in the Coppa Italia twice as well (2021/22 and 2022/23). Additionally, the Nerazzurri claimed three Italian Supercups and reached the finals of the UEFA Europa League (2019/20) and Champions League (2022/23).

Off-pitch the change in ownership had an immediate and significant impact on the club’s revenues. From 2015/16 to 2016/17 revenues surged by 44% and doubled within two seasons. This impressive growth was largely fueled by Asian sponsorships linked to the Suning Group and the club’s return to the UEFA Champions League. However, the upward trajectory was abruptly halted by the COVID-19 pandemic during the 2019/20 season. The pandemic directly affected the club through reduced stadium income and indirectly impacted it as the Suning Group experienced substantial economic losses.

Furthermore, the club’s commercial revenues were significantly affected by the expiration of several regional Asian sponsorships, with their value decreasing from EUR 96.9m in 2018/19 to EUR 38.2m in 2020/21. However, the club managed to restart its growth path, capitalizing on its brand internationalization efforts and reaching new record operating revenues of EUR 386m in 2022/23, boosted by the UEFA Champions League final.

According to the most recent figures for the 2022/23 season, FC Inter rank as the third highest Italian club in terms of total operating revenues. They trail behind Juventus FC, which boast EUR 435m, and AC Milan with EUR 394m. The disparity is primarily attributed to lower commercial revenues. On the European stage, FC Inter are positioned as the 15th club by total operating revenues.

In addition to their Scudetto victory, the 2023/24 revenues of the Nerazzurri will also benefit from record attendance figures and the expected commercial boost from the annual sponsorship agreement with Paramount+, replacing the defaulting sponsor DigitalBits.

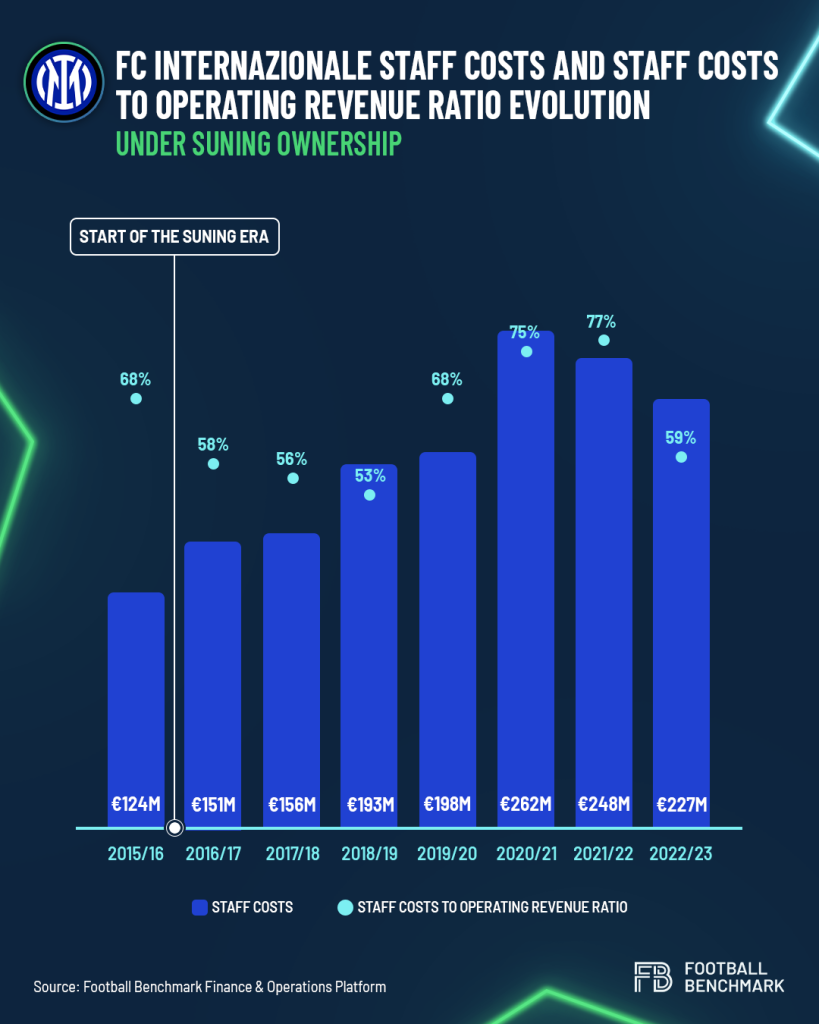

On the expenses side, since 2016/17, staff costs consistently increased, peaking at EUR 262m in the 2020/21 season. However, this trend reversed over the past two seasons, with total staff costs decreasing by 13%, down to EUR 227m in 2022/23. This reduction was partly due to the sales of high-profile players like Lukaku and Hakimi.

During the timeframe under analysis, the staff costs to operating revenue ratio fluctuated, reaching its highest value of 77% in 2021/22 and decreasing to a sustainable 59% in 2022/23.

Regarding the club’s profitability, FC Inter have recorded a cumulative net loss of EUR 724m over the last eight seasons. Since Suning’s arrival, Inter have always ended each season in the red. The loss of EUR 246m recorded in 2020/21 marks the highest ever for a Serie A club. However, due to increased revenues, savings on staff costs, and income from player trading, the annual loss was significantly reduced to EUR 85m in 2022/23.

Despite being eliminated in the UCL round of 16 this season, recent estimates suggest that the club should see further profitability improvements in 2023/24 and reduce their losses to approximately EUR 50m. Contributing factors include the victory in Serie A, increased commercial revenues, effective cost control and expected player trading income, primarily from the sale of Onana to Manchester United FC and Brozović to Al-Nassr FC.

Moving to the balance sheet situation, as of 30th June 2023, FC Internazionale’s net financial debt[1] stood at EUR 437m, marking the second highest figure recorded by the club over the past decade and the highest among Serie A clubs at conclusion of the 2022/23 season. This debt is primarily attributed to the EUR 415m bond issued by the subsidiary company Inter Media and Communication in February 2022, maturing in 2027. The financial liabilities have significantly impacted also the club’s profitability, with FC Inter averaging annual financial costs of EUR 38m over the 8-year timeframe under consideration.

Net financial debt is the sum of interest-bearing current and long-term loans and borrowings, minus cash and cash equivalents. It does not include debt towards clubs, other trade debtors, employees/players, tax authorities and all other debts which are not interest-bearing (incl. shareholders’ debt).

In the last eight seasons under Suning’s ownership, FC Inter have recorded a cumulative negative transfer market balance of EUR 205m, averaging approximately EUR 26m per year. However, focusing solely on the last four seasons, the balance shows a significant positive trend (+EUR 131m). Indeed, over recent seasons, transfer market spending has decreased considerably, partly due to acquiring several players on free transfers. Noteworthy examples include Çalhanoğlu, Mkhitaryan, Onana and Thuram.

The 2019/20 season saw the highest total expenditure at EUR 192m. In that season, the most expensive signings were Lukaku (EUR 74m) and Eriksen (EUR 27m). Conversely, the 2021/22 season recorded the highest positive net balance (+EUR 163m), primarily due to the sales of Lukaku (EUR 113m to Chelsea FC) and Hakimi (EUR 68m to Paris Saint-Germain FC).

In the recently concluded 2023/24 season, the balance is significantly positive, primarily due to a low-cost acquisition campaign (except for Pavard, who was purchased for around EUR 30m) and the sale of Onana for reported EUR 50m to Manchester United FC, alongside transfers involving Pinamonti, Brozović and Gosens.

Turning to squad market valuation, as of 1st June 2024, the Nerazzurri lead Serie A with a valuation of EUR 649m, ahead of AC Milan (EUR 603m), SSC Napoli (EUR 555m), and Juventus FC (EUR 431m). The most valuable players are Lautaro Martínez (EUR 101m), followed by Barella (EUR 83m) and Bastoni (EUR 74m). The club’s management and coach, Simone Inzaghi, have demonstrated exceptional skill in player valorisation, exemplified by Thuram and Çalhanoğlu. Both players were acquired at no cost and are currently valued at EUR 70 million and EUR 42 million, respectively.

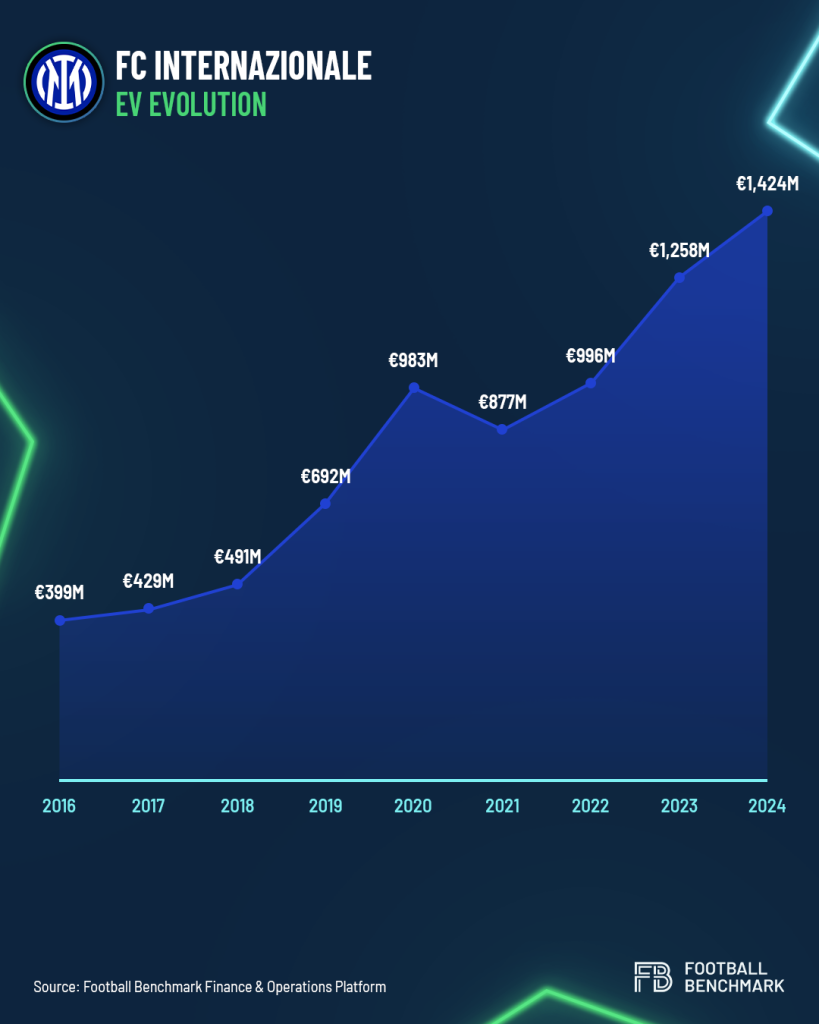

All the aforementioned factors resulted in a remarkable growth of the Enterprise Value (EV) from EUR 399m in 2016 to EUR 1,424m as of January 2024, marking a 257% 8-year increase, the fourth highest among the clubs included in “The European Elite” report since its first edition.

Despite this consistent growth, in the latest edition of the report, for the first time since 2018, AC Milan (14th) surpassed FC Inter (15th) in the EV ranking, albeit by only EUR 12m. The Rossoneri’s recent achievements in revenue growth and profitability, coupled with challenges faced by FC Inter regarding their main jersey sponsor, are the main reasons for this change in ranking.

The club’s new owners, Oaktree Capital Management, have swiftly taken action by appointing a new Board of Directors, with CEO Sport Giuseppe Marotta assuming the role of President. Interestingly, Oaktree brings prior experience in the football industry, having held an 80% stake in SM Caen in the French Ligue 2 since 2020.

It remains to be seen what investment strategy the asset management firm will adopt for the Nerazzurri. Initially, alternative options were an immediate resale of the club or a long-term commitment to enhance the asset’s value. Based on their initial moves and the firm’s official public statements, it appears they have opted for a long-term commitment.

Looking at what happened with city rivals AC Milan, Oaktree may attempt to replicate what Elliot Management did: they took control of AC Milan due to a missed payment of EUR 415m in 2018 and reportedly sold the club in 2022 for EUR 1,200m.

The efforts of the new ownership will focus on enhancing the club’s value to achieve a higher return on investment upon exit. This valorisation strategy is expected to encompass the following main pillars:

Increasing operating revenues: further boosting stadium income by capitalizing on the record attendance performance, increasing UEFA income through sustained performance in the UEFA Champions League (especially in the new, more lucrative format), tapping into new revenue streams from the FIFA Club World Cup, and bolstering commercial income (e.g., new main shirt sponsor and new naming rights deal for the training centre).

Leveraging player trading income: achieving profits from player sales through consistent squad valorisation.

Cost control strategy: with a particular emphasis on managing squad costs, in line with UEFA’s squad cost ratio requirements, and reducing financial costs.

New stadium project: potentially developing a new venue or refurbishing San Siro.

The importance of each of these aspects will hinge on the new management’s decisions, which face the intricate challenge of balancing fan expectations for sporting success and squad competitiveness with financial sustainability.

his article was produced by Football Benchmark.