The plan after the storm: the challenges of Ligue 1 towards growth and financial sustainability

Once a vibrant display of French football talent, Ligue 1 now faces a critical turning point. The league’s financial health has been steadily declining compared to other European leagues, driven by escalating costs and an overdependence on player trading, exacerbating its vulnerability. The absence of a robust financial regulatory framework, combined with a challenging domestic media landscape, has placed the league in a difficult situation.

After the fresh re-election of Vincent Labrune as the President of the LFP, the governing body of professional French football leagues, it is now time for widespread changes. To ensure long-term success, the league requires not only a major business model transformation, but also better alignment to guide its clubs toward financial stability. While the involvement of CVC has initiated governance reforms and boosted non-media revenue growth, significant obstacles still lie ahead.

This article explores the recent landscape of Ligue 1, shedding light on the root causes of its challenges, while also highlighting potential opportunities for sustainable growth.

Broadcast Tender Results Expose Ligue 1’s Underlying Problems

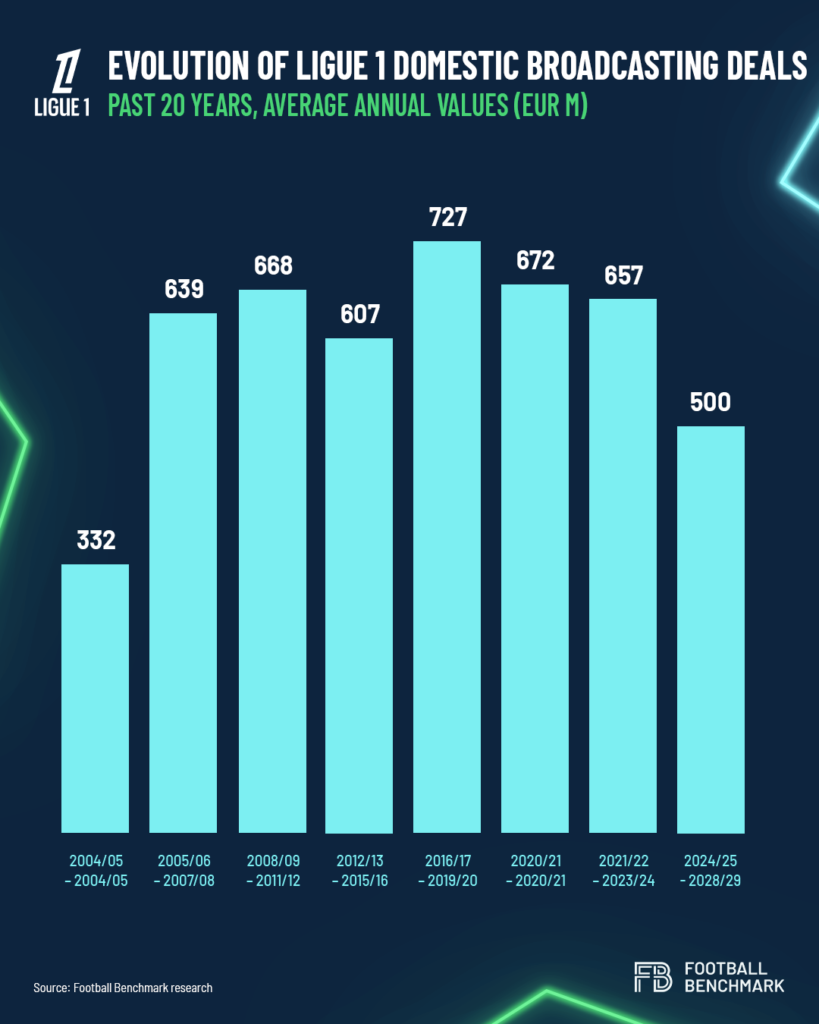

The value of Ligue 1’s TV rights have fluctuated significantly over the past decade, with a noticeable decline since the COVID-19 pandemic. After a period of growth during the 2016/17–2019/20 cycle and the promise of a lucrative long-term deal with Mediapro – which was abruptly terminated – the league has faced ongoing challenges in selling its media rights. These issues reached a peak this summer, when Ligue 1 managed to secure a deal just one month before the start of the 2024/25 season.

With DAZN securing the rights to broadcast eight games per matchday for €400 million and beIN SPORTS France acquiring the remaining weekly match for €100 million, Ligue 1’s total revenue from media rights has fallen to around €500 million, down 32% from its peak value pre-COVID. As a result, the value of Ligue 1 rights in its domestic market is now very close to that of UEFA competitions in the French territory. This decline has been further compounded by the delayed bidding process, leaving clubs to set their season budgets months in advance without certainty.

Illegal streaming, a major concern for the league, has accelerated, driven by widespread dissatisfaction with DAZN’s initial pricing – freshly and temporarily revised down from €29.99 to €19.99 per month following controversies. A survey by the Odoxa institute reveals that 65% of football fans believe DAZN’s pricing for Ligue 1 justifies resorting to piracy to watch the French top division. The report also highlights that around 5% of French viewers (ca. 2.5 million people) are already watching football illegally – significantly surpassing DAZN’s target of 1.5 million subscribers. It is therefore apparent that the issues are not just related to a lack of local demand.

Although the current media rights deals extend through the end of the 2028/29 season, a break clause offers an opportunity to renegotiate and potentially secure more favorable terms. However, it also poses a risk to stabilizing this vital revenue stream if DAZN and beIN SPORTS fail to achieve their anticipated value from the broadcasts.

Challenges Facing Ligue 1: Navigating Financial Instability

Ligue 1’s financial health has been declining relative to its European peers. Unlike other top European leagues, the French league lacks a robust financial regulatory framework that fosters long-term sustainability. The league’s financial regulatory body, the Direction Nationale du Contrôle de Gestion (DNCG), primarily ensures that clubs have sufficient cash flow for each season’s operations. However, this emphasis on short-term financial oversight does not address issues such as long-term investment strategies or debt management, making clubs ultimately less appealing to potential investors.

A closer examination of the financial performance of individual clubs reveals more about Ligue 1’s struggles. Historic clubs such as Olympique de Marseille, Olympique Lyonnais, FC Girondins de Bordeaux, and AS Saint-Étienne have all recorded substantial losses in recent years.

Lyon have relied on the sale of its women’s team and indoor arena to address the capital needs of the men’s team. Bordeaux’s financial issues resulted in bankruptcy after Fenway Sports Group withdrew from a potential acquisition, reportedly due to concerns over the state of the French football economy. In contrast, smaller clubs (e.g.: Stade de Reims, Stade Brestois 29) have shown relatively better financial stability, benefitting from lower operating costs and therefore more flexibility in adjusting to economic fluctuations.

Adding to the league’s challenges, Ligue 1 is facing a notable absence of a clear global star player for the first time in years. The departures of Kylian Mbappé, Lionel Messi, and Neymar Jr. have significantly impacted Ligue 1’s appeal and marketability. Currently, Marco Asensio (31.5 million combined followers) is the most followed player in the French top division, barely making it to the top 50 globally.

Key Reforms: Navigating Change Amid Financial Challenges

To tackle these issues, Ligue de Football Professionnel (LFP), the governing body of French football, secured a €1.5 billion investment from private equity firm CVC Capital Partners in 2022, in exchange for a 13% stake in the LFP’s commercial arm. However, two years later, capital distributions seem to have been primarily used to address operational cash needs rather than to accelerate the league’s transformation.

While the financial results for the 2022/23 season might appear improved due to the income from CVC, it is crucial to recognize that capital distributions are classified as extraordinary revenue, temporarily inflating clubs’ financial figures and skewing comparisons with past seasons and other leagues.

In parallel, Ligue 1 has reduced the number of clubs from 20 to 18, starting from the 2023/24 season, to improve product quality, boost the revenue distribution per club and alleviate fixture congestion for teams competing in Europe. The early returns of this adjustment are promising. Last season, Paris Saint-Germain FC and Olympique de Marseille reached the semi-finals of their respective UEFA competitions, while LOSC Lille advanced to the quarter-finals of the UEFA Conference League.

Recent commercial improvements are also notable. McDonald’s three-year title sponsorship agreement (€20 million per season) represents a €5 million increase over the previous deal with Uber Eats. LFP has also secured a five-year agreement (€31 million/year) with Infront Bettor for its live betting video and data rights, excluding France. The recent acquisition of fantasy football company Mon Petit Gazon also provides additional room for growth in this field.

Moving Forward: Reconquering the Domestic Market

These positive developments are overshadowed by the underlying challenge of a complex domestic market for sports media rights. As a result, the real opportunity for LFP relies on reconquering its domestic media market, in which the dominant player, Canal+, has now allocated most of its budget towards other properties (UEFA, Premier League). The new linear-TV free-to-air coverage of Ligue 1 highlights is a good first step to capture new audiences. Real success will be measured by LFP’s ability to drive competitive tension, helping DAZN to set solid foot on the local market, re-establish its relationship with Canal+ and position itself as an attractive entry door for new media players.

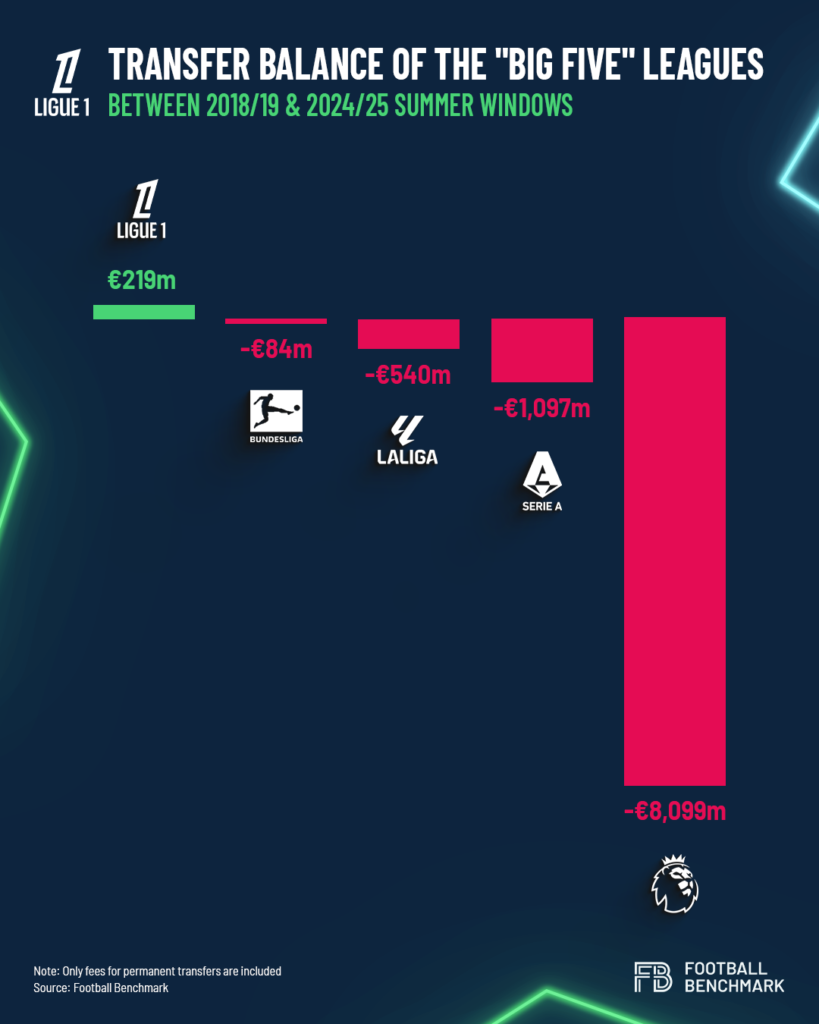

In the meantime, French clubs shall rely on one of their traditional strengths, their capacity to develop young talent. While a model based on consistently selling the best talent is not sustainable, it offers a foundation upon which the league can build a more robust financial strategy. Since the summer transfer window of 2018/19, Ligue 1 has distinguished itself among the “Big Five” European leagues by maintaining a positive net transfer balance. With a net surplus of €218.8 million stands well ahead the Bundesliga (net negative balance of €83.7 million), La Liga (€-539.9 million), Serie A (€-1.1 billion) and the Premier League (€-8.1 billion).

During this transitory period, the league may also attract new investment. The devaluation of clubs and the availability of talent present attractive opportunities for long-term financial gains. However, it is crucial to ensure an alignment between the vision and objectives of the league and interested investors, with a focus on improving Ligue 1 as a media product. Otherwise, beyond its very top clubs, the league risks becoming a platform for multi-club structures, adding to the likes of Troyes (CFG), Lorient (Black Knight/Bournemouth), and Strasbourg (BlueCo/Chelsea). Attracting major French investors and corporations, who have long stayed far from Ligue 1, may represent an untapped opportunity.

After a troubled summer, the underlying challenges of Ligue 1 have now been exposed and French club football stakeholders are now expected to align on the urgent need for action. The road to recovery will be long, even if some encouraging first steps, such as the continued rise of stadium attendances and the return of Ligue 1 highlights to free-to-air TV already highlight some momentum towards long-term growth.